Treasury stock is the term that is used to describe shares of a company’s own stock that it has reacquired. A company may buy back its own stock for many reasons. A frequently cited reason is a belief by the officers and directors that the market value of the stock is unrealistically low. As such, the decision to buy back stock is seen as a way to support the stock price and utilize corporate funds to maximize the value for shareholders who choose not to sell back stock to the company.

Other times, a company may buy back public shares as part of a reorganization that contemplates the company “going private” or delisting from some particular stock exchange. Further, a company might buy back shares and in turn issue them to employees pursuant to an employee stock award plan.

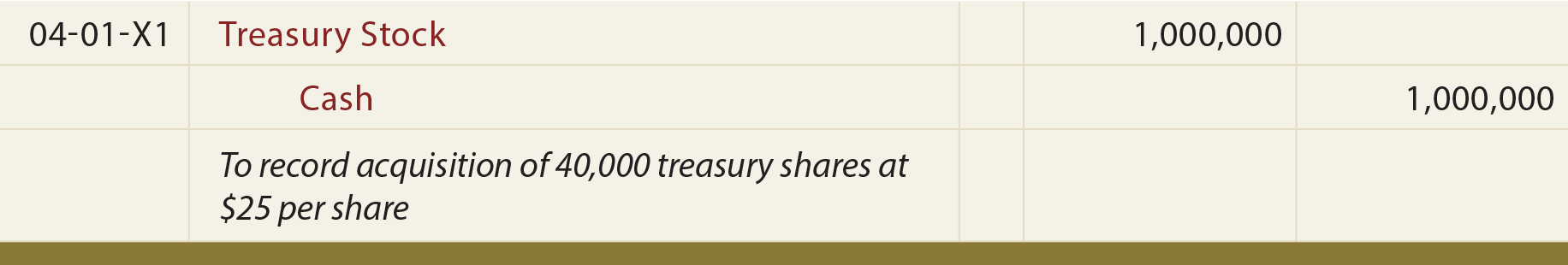

Whatever the reason for a treasury stock transaction, the company is to account for the shares as a purely equity transaction, and “gains and losses” are ordinarily not reported in income. Procedurally, there are several ways to record the “debits” and “credits” associated with treasury stock, and the specifics can vary globally. The “cost method” is generally acceptable. Under this approach, acquisitions of treasury stock are accounted for by debiting Treasury Stock and crediting Cash for the cost of the shares reacquired:

The effect of treasury stock is very simple: cash goes down and so does total equity by the same amount. This result occurs no matter what the original issue price was for the stock. Accounting rules do not recognize gains or losses when a company issues its own stock, nor do they recognize gains and losses when a company reacquires its own stock. This may seem odd, because it is certainly different than the way one thinks about stock investments. But remember, this is not a stock investment from the company’s perspective. It is instead an expansion or contraction of its own equity.

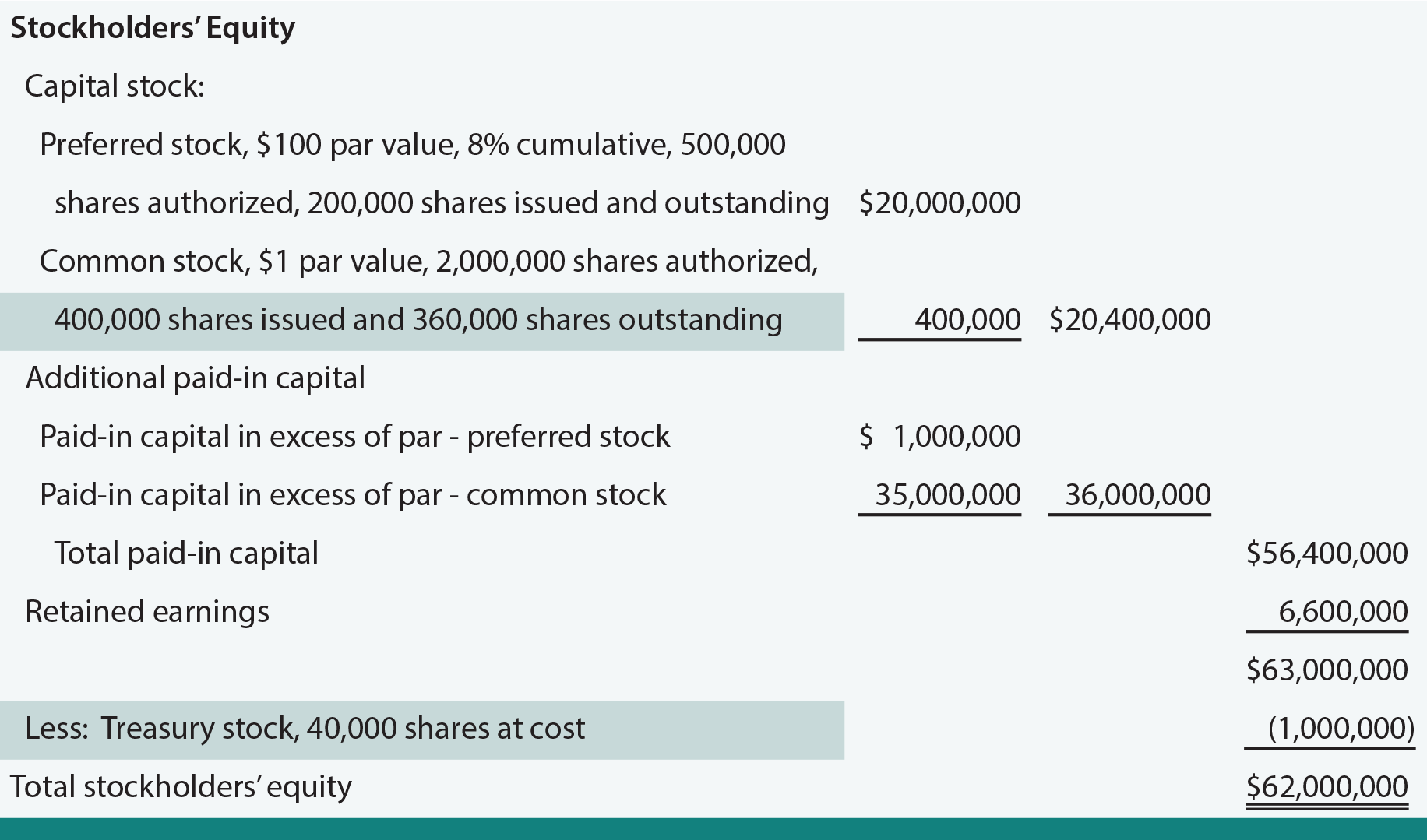

Treasury Stock is a contra equity item. It is not reported as an asset; rather, it is subtracted from stockholders’ equity. The presence of treasury shares will cause a difference between the number of shares issued and the number of shares outstanding. Following is Embassy Corporation’s equity section, modified (see highlights) to reflect the treasury stock transaction portrayed by the entry.

If treasury shares are reissued, Cash is debited for the amount received and Treasury Stock is credited for the cost of the shares. Any difference may be debited or credited to Paid-in Capital in Excess of Par.

| Did you learn? |

|---|

| What is treasury stock, and where is it positioned on a balance sheet? |

| Prepare journal entries for treasury stock transactions, including reissuances. |

| Do gains and losses arise on treasury stock transactions? |

| Can retained earnings be increased or decreased as a result of treasury stock transactions? |