What exactly is cash? This may seem like a foolish question until one considers the possibilities. Cash includes coins and currency. But what about items like undeposited checks, certificates of deposit, and similar items? Generalizing, cash includes those items that are acceptable to a bank for deposit and are free from restrictions (i.e., available for use in satisfying current debts). Cash typically includes coins, currency, funds on deposit with a bank, checks, and money orders.

What exactly is cash? This may seem like a foolish question until one considers the possibilities. Cash includes coins and currency. But what about items like undeposited checks, certificates of deposit, and similar items? Generalizing, cash includes those items that are acceptable to a bank for deposit and are free from restrictions (i.e., available for use in satisfying current debts). Cash typically includes coins, currency, funds on deposit with a bank, checks, and money orders.

Items like postdated checks, certificates of deposit, IOUs, stamps, and travel advances are not classified as cash. These would customarily be classified in accounts such as receivables, short-term investments, supplies, or prepaid expenses. The existence of compensating balances (amounts that must be left on deposit and not withdrawn) should be disclosed and, if significant, reported separately from cash.

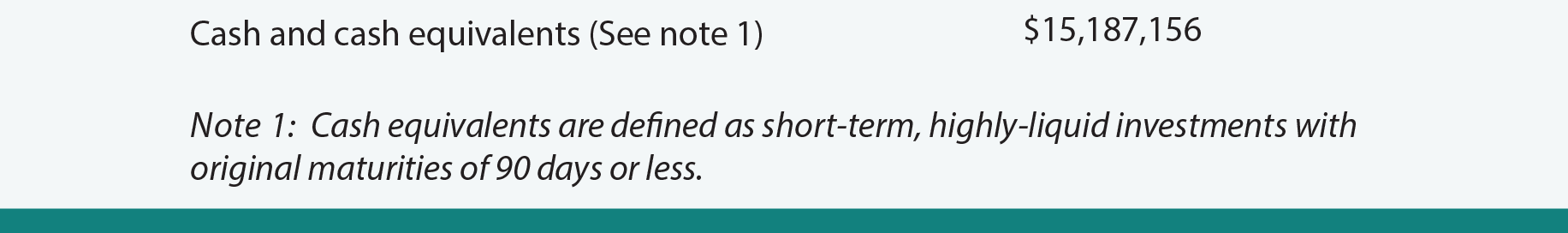

Separate treatment is also given to “sinking funds” (monies that must be set aside to satisfy debts) and restricted foreign currency holdings (that cannot easily be transferred or converted into another currency). These unique categories of funds may be reported in the long-term investments category. Some companies will report “cash and cash equivalents“:

Cash equivalents arise when companies place their cash in very short-term financial instruments that are deemed to be highly secure and will convert back into cash within 90 days (e.g., short-term government-issued treasury bills). These financial instruments are usually very marketable in the event the company has an immediate need for cash.

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| Define cash. |

| Know which items are properly classified as cash, and which are not. |

| Understand the concepts of compensating balances and cash equivalents. |