Most items of PP&E require substantial ongoing costs to keep them in good order. The accounting rules for such costs treat them as “capital expenditures” if future economic benefits result from the expenditure. Future economic benefits occur if the service life of an asset is prolonged, the quantity of services expected from an asset is increased, or the quality of services expected from an asset is improved. Expenditures not meeting at least one of these criteria should be accounted for as a revenue expenditure and be expensed as incurred. Judgment is required in applying these rules.

Most items of PP&E require substantial ongoing costs to keep them in good order. The accounting rules for such costs treat them as “capital expenditures” if future economic benefits result from the expenditure. Future economic benefits occur if the service life of an asset is prolonged, the quantity of services expected from an asset is increased, or the quality of services expected from an asset is improved. Expenditures not meeting at least one of these criteria should be accounted for as a revenue expenditure and be expensed as incurred. Judgment is required in applying these rules.

A literal reading might lead one to believe that routine maintenance would be capitalized. After all, fueling a car does extend its service life. But, that interpretation would miss the intent of the rule. It is implied that routine costs to maintain normal operating condition be expensed as incurred. The capitalization criteria are instead focused on nonrecurring costs.

Restore and Improve

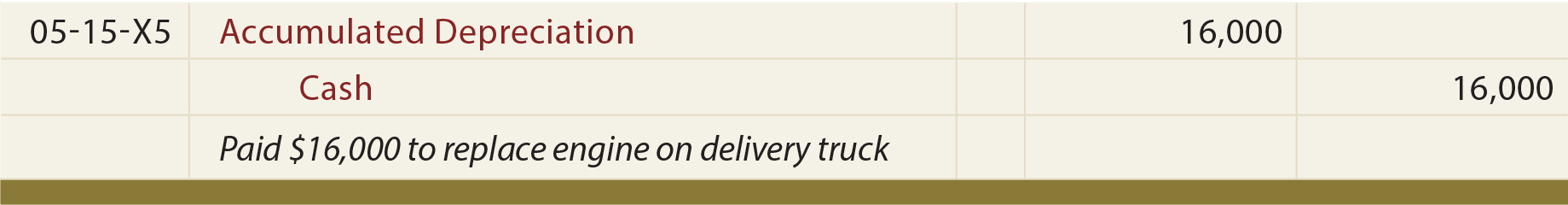

A truck may have an engine that is in need of replacement. The replacement of the engine represents a “restoration” of some of the original condition (akin to “undepreciating”). Restoration and improvement type costs are considered to meet the conditions for capitalization because of the enhancement to service life/quality. This entry records the restoration:

Notice that the preceding debit is to Accumulated Depreciation. The effect is to increase the net book value of the asset by reducing its accumulated depreciation on the balance sheet. This approach is perfectly fine for “restoration” expenditures. However, if one is “improving” the asset beyond its original condition (sometimes termed a betterment), the costs would instead be capitalized by debiting the asset account directly.

| Did you learn? |

|---|

| Define capital expenditure and revenue expenditure. |

| What three conditions help an item qualify as a capital expenditure? |

| Make a distinction between the accounting for a replacement and a betterment. |