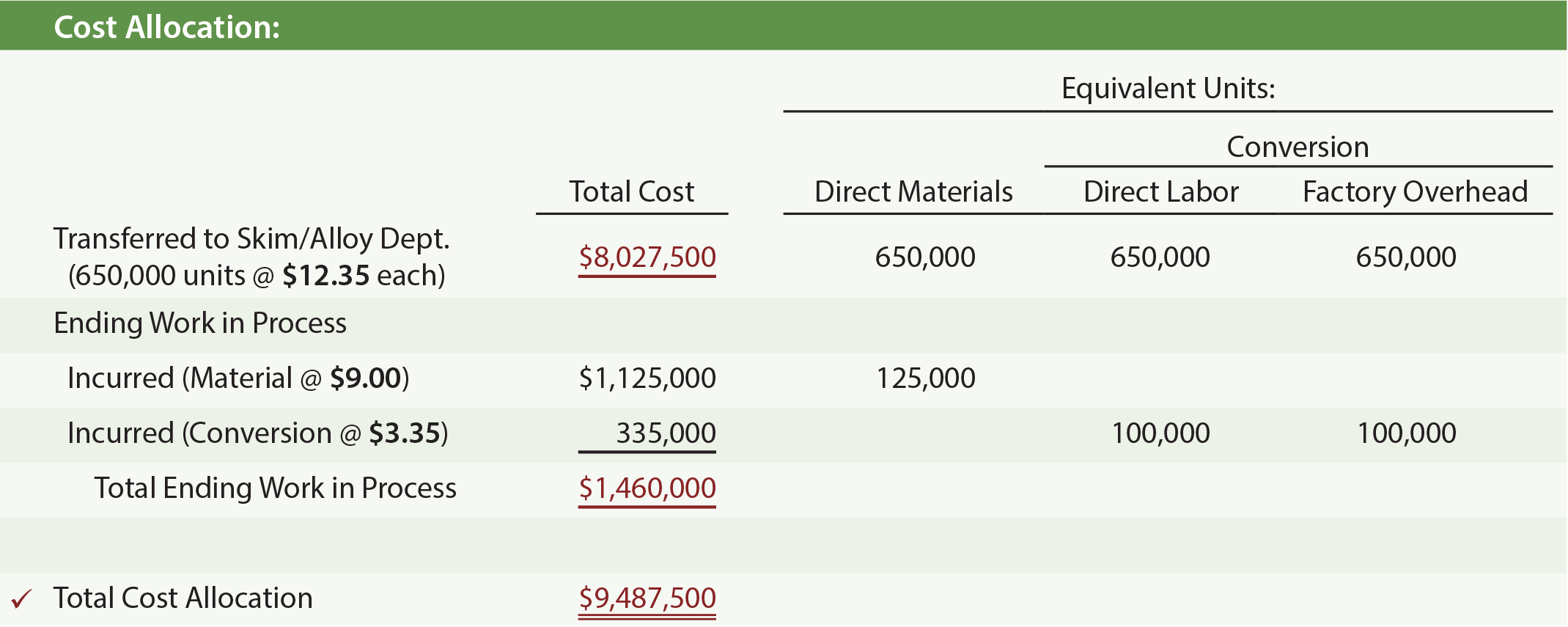

The cost per equivalent unit calculations are used to allocate cost incurred between a department’s completed production and the units in ending work in process. Carefully examine the following schedule to see that the cost assigned to completed units totals $8,027,500. The ending work in process is $1,460,000, determined as 125,000 equivalent units at $9.00 each, plus 100,000 equivalent units of conversion at $3.35 each.

Note that a check mark is placed beside the total cost allocation ($9,487,500 = $8,027,500 + $1,460,000) as a reminder that this schedule must allocate the entire cost incurred within the Melting Department.

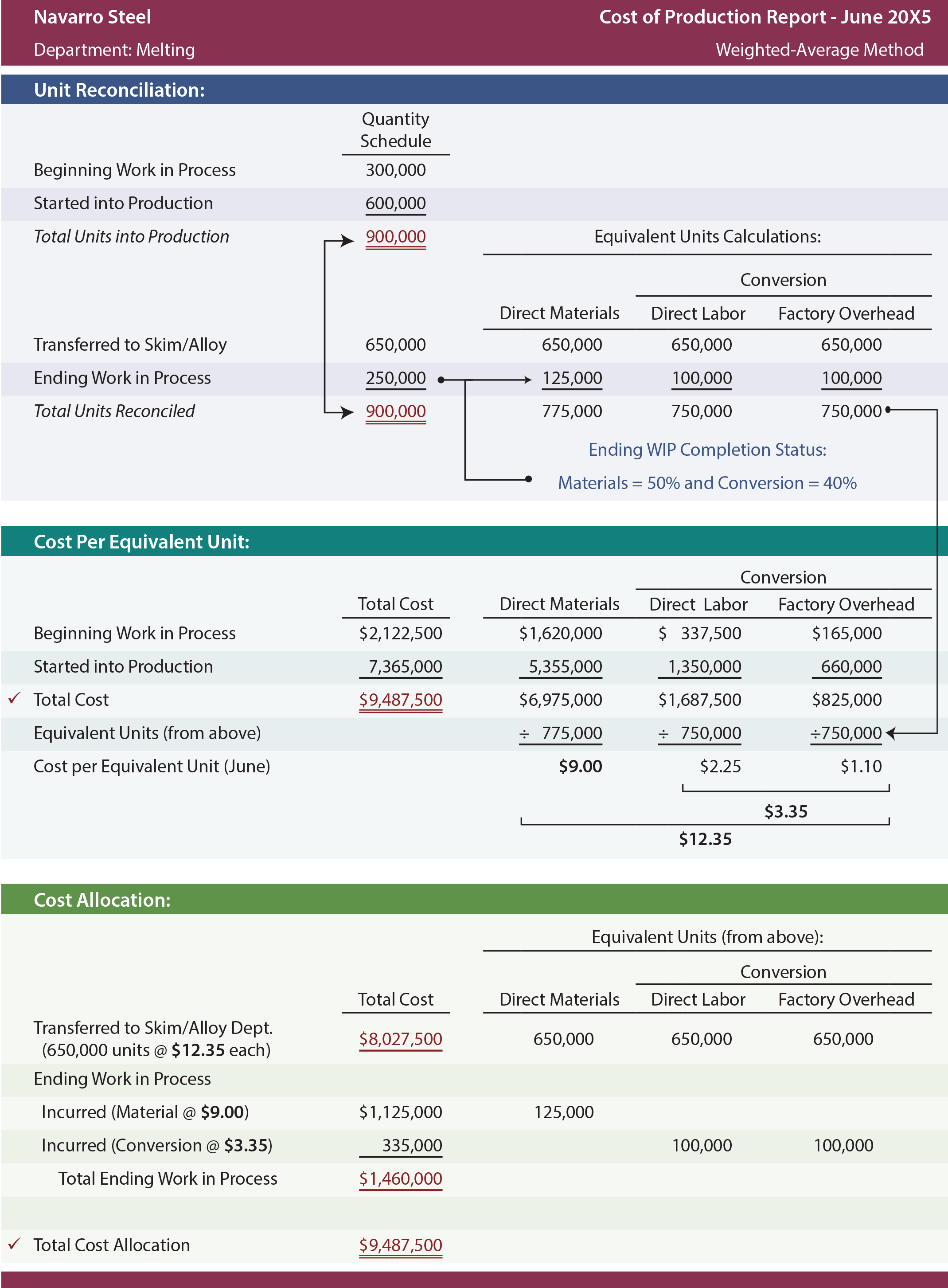

Cost Of Production Report

The preceding schedules are combined into a single cost of production report as shown below. A similar report would be prepared for each department.

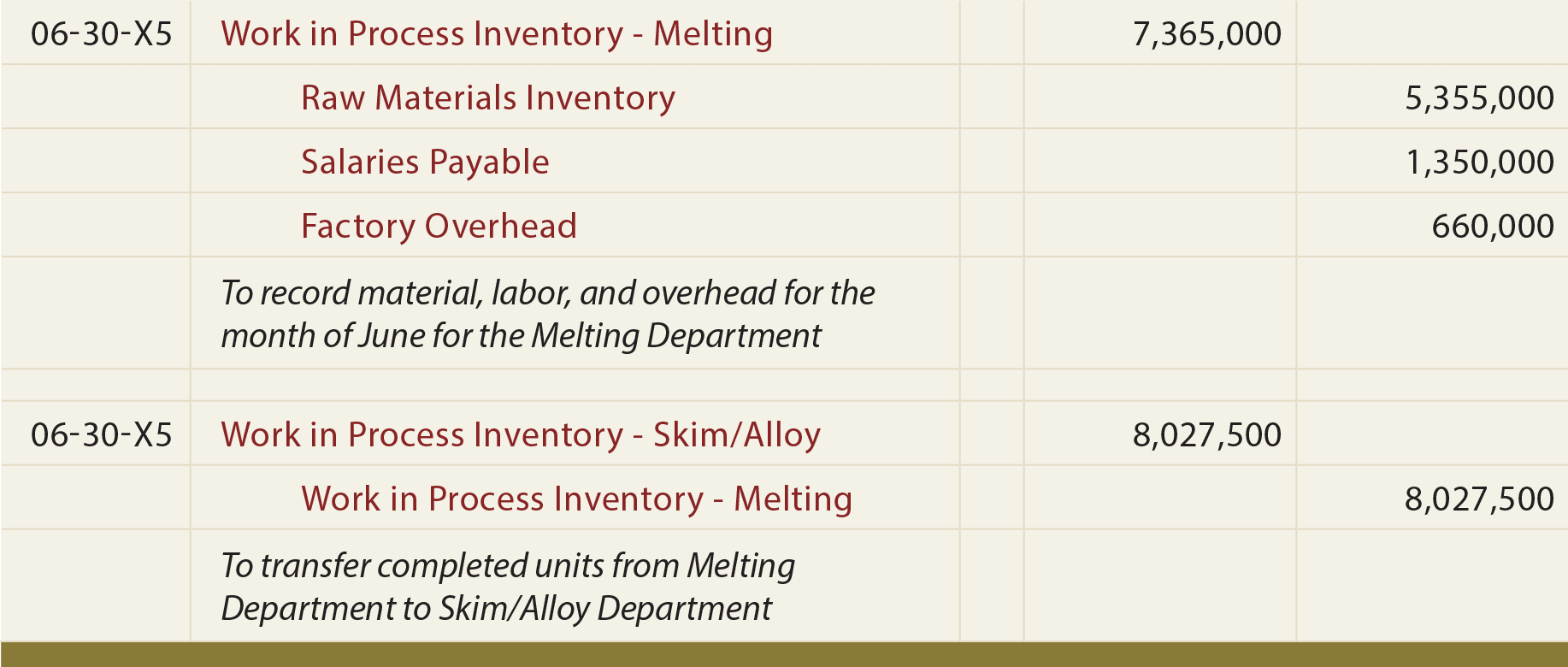

These reports are used for many management purposes, such as inventory control, efficiency studies, incentive pay plans, and the like. They also provide the basis for the following entries that are needed to update the ledger accounts for the inventory cost allocations.

Analysis of Cost Flow

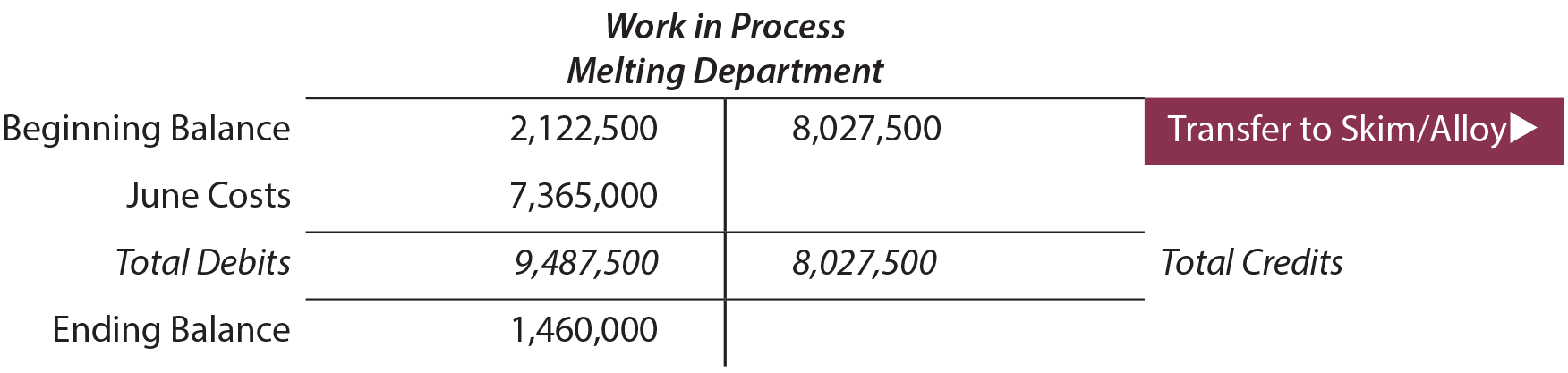

The journal entries, along with the beginning work in process of $2,122,500, result in an ending work in process of $1,460,000.

The following T-account portrays the cost flow through the Work in Process account of the Melting Department:

Added Processes

It is important to notice that the journal entry to transfer $8,027,500 out of the Melting Department (credit) is offset with an increase in the Work in Process of the Skim/Alloy Department (debit).

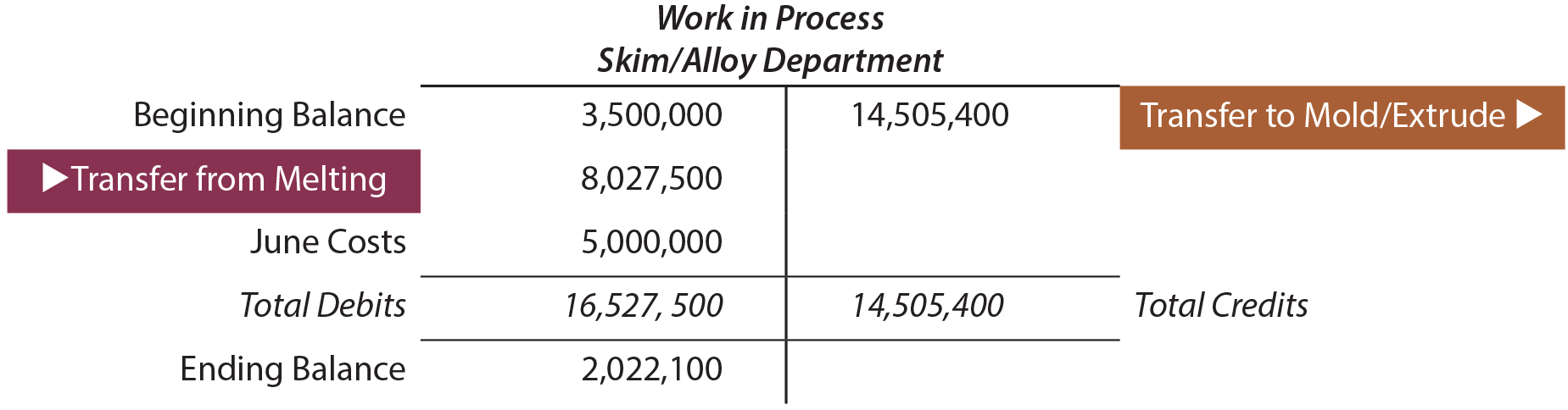

The Skim/Alloy Department’s T-account for June might look something like this (amounts are assumed):

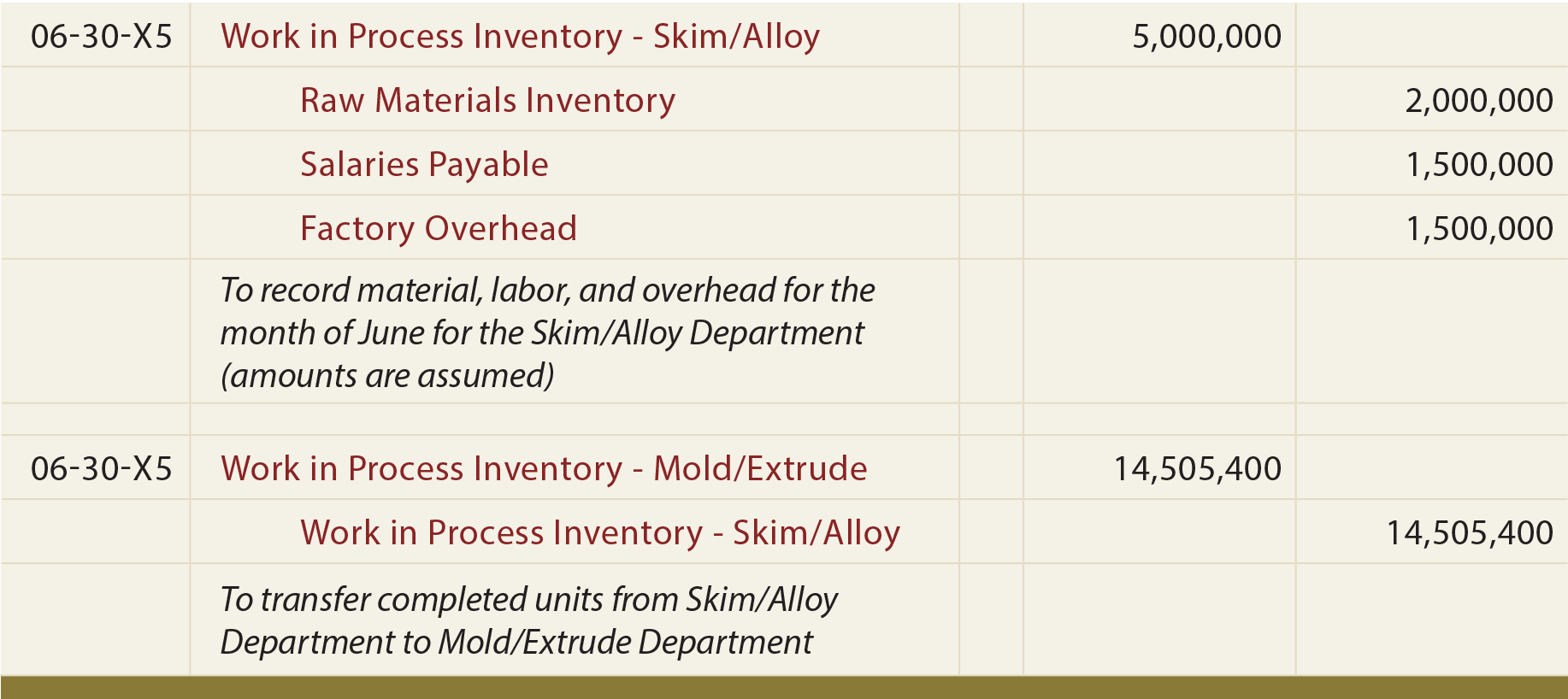

The corresponding journal entries for the Skim/Alloy Department for June are as follows:

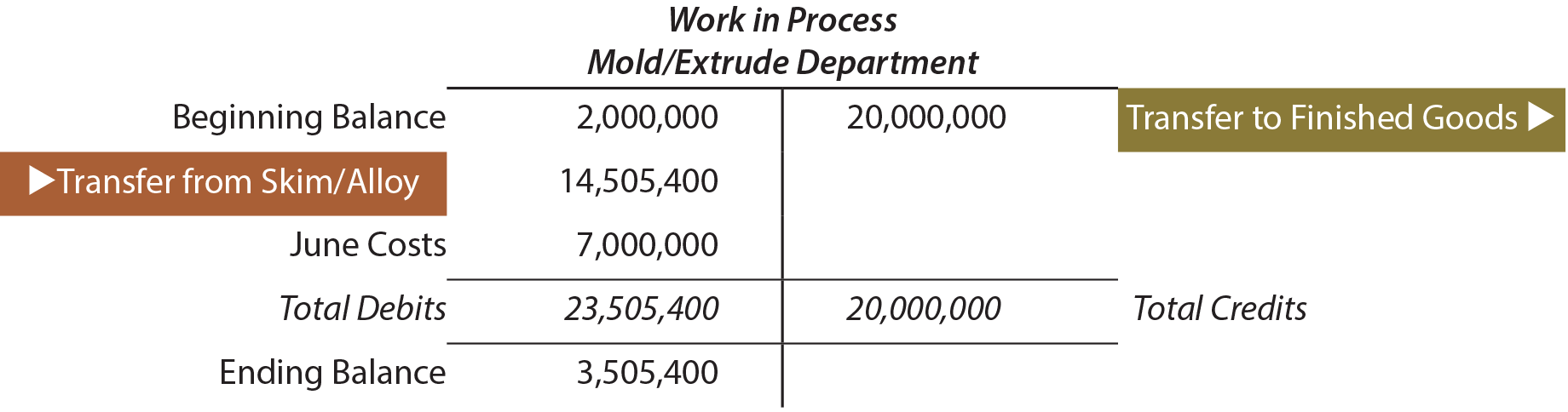

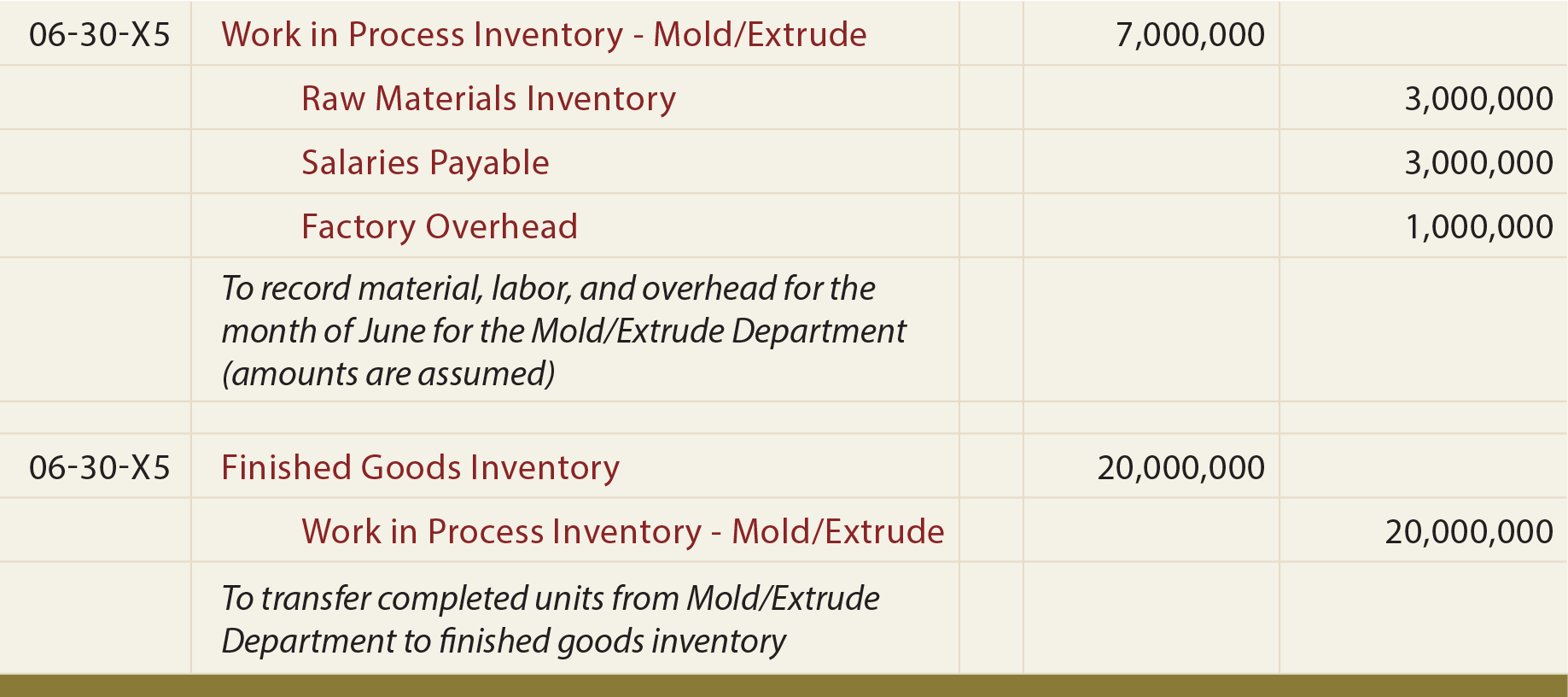

Assume the Mold/Extrude Department has the following T-account and related entries.

The costs transferred from the Mold/Extrude unit go to the finished goods inventory since this is the final process.

As noted within the journal entry descriptions, all costs for each department were assumed. But, overhead is not in direct proportion to salaries payable for each department. This is not unexpected as there is no requirement that overhead be applied at the same rate, or on the same basis, in different departments.

Overall Review

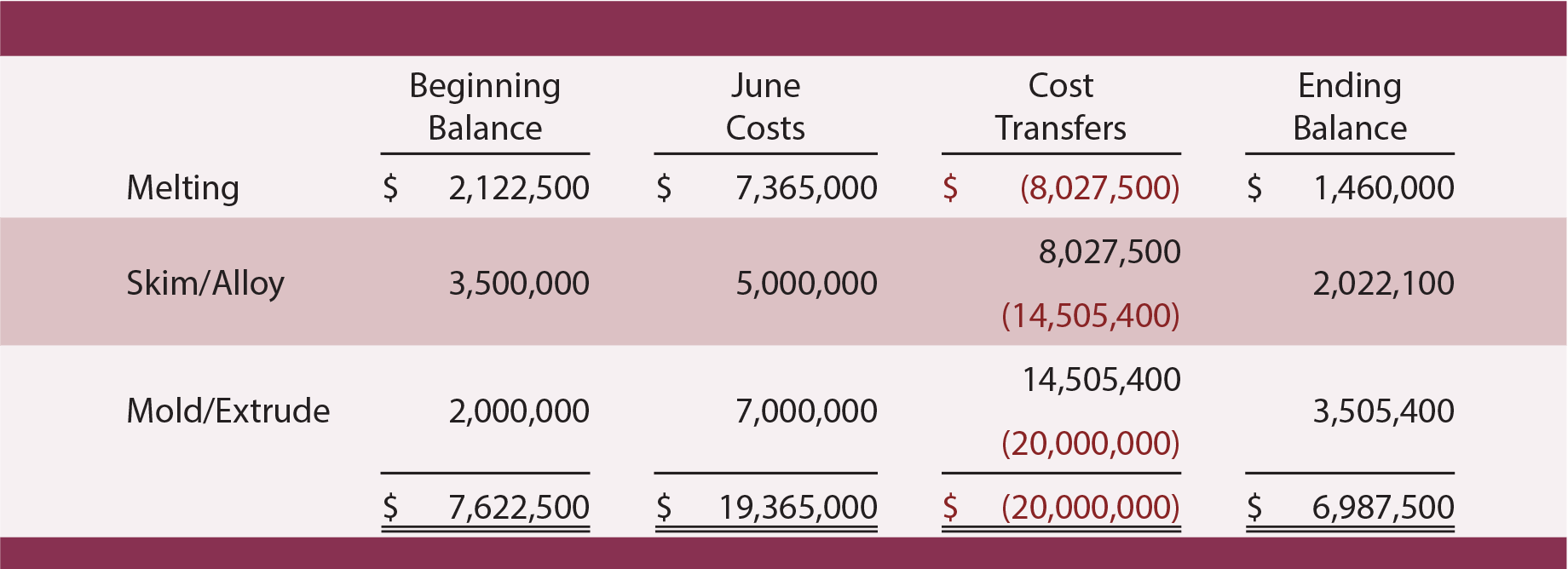

The schedule below shows that Navarro incurred $19,365,000 in costs and transferred $20,000,000 to finished goods. Total work in process inventory declined by $635,000. This is verified by comparing the beginning and ending work in process balances ($7,622,500 – $6,987,500 = $635,000). Navarro’s balance sheet at June 30 would include $6,987,500 as work in process inventory.

| Did you learn? |

|---|

| Be able to prepare a cost of production report (using the weighted-average method). |

| Identify the nature and timing of journal entries that are necessitated by process costing. |

| Understand the overall cost flow from department to department, and how total inventory costs are compiled. |