Reversing entries are optional accounting procedures which may sometimes prove useful in simplifying record keeping. A reversing entry is a journal entry to “undo” an adjusting entry. Consider the following alternative sets of entries.

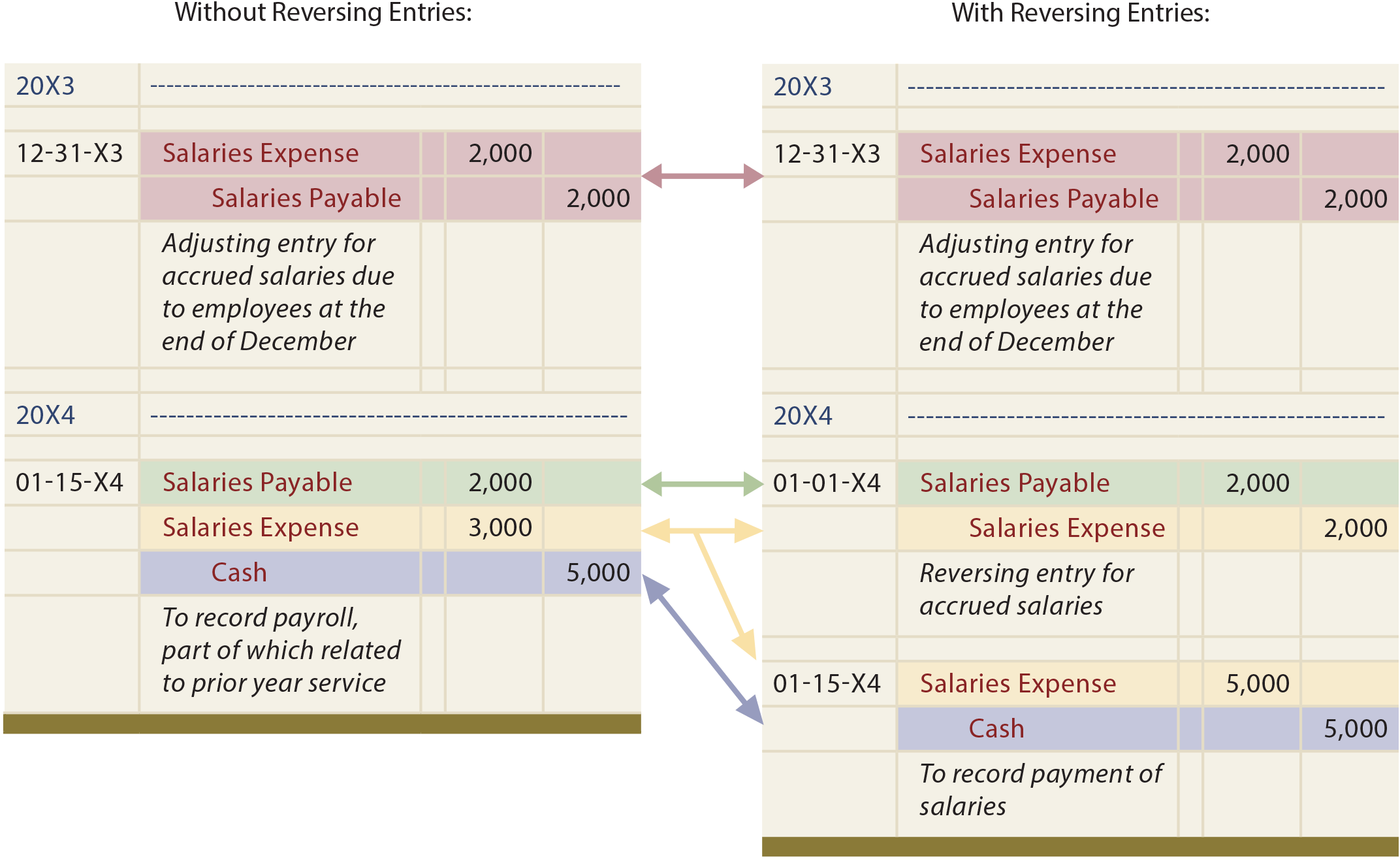

The first example does not utilize reversing entries. An adjusting entry was made to record $2,000 of accrued salaries at the end of 20X3. The next payday occurred on January 15, 20X4, when $5,000 was paid to employees. The entry on that date required a debit to Salaries Payable (for the $2,000 accrued at the end of 20X3) and Salaries Expense (for $3,000 earned by employees during 20X4).

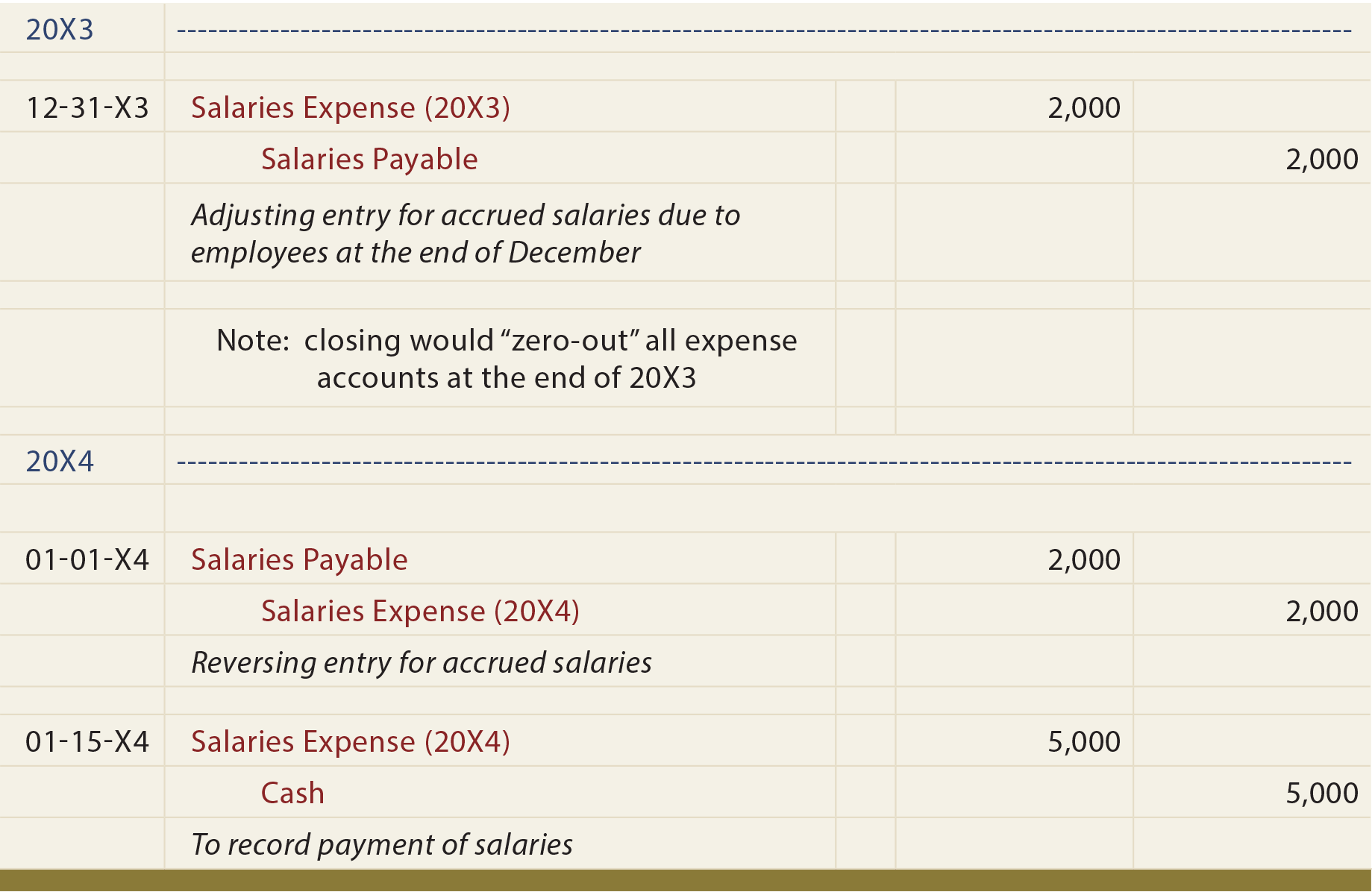

The next example revisits the same facts using reversing entries. The adjusting entry in 20X3 to record $2,000 of accrued salaries is the same. However, the first journal entry of 20X4 simply reverses the adjusting entry. On the following payday, January 15, 20X5, the entire payment of $5,000 is recorded as expense.

Illustration Without Reversing Entries

Illustration With Reversing Entries

The net impact with reversing entries still records the correct amount of salary expense for 20X4 ($2,000 credit and $5,000 debit, produces the correct $3,000 net debit to Salaries Expense). It may seem odd to credit an expense account on January 1, because, by itself, it makes no sense. The credit only makes sense when coupled with the subsequent debit on January 15. Notice from the following diagram that both approaches produce the same final results:

BY COMPARING THE ACCOUNTS AND AMOUNTS, NOTICE THAT THE SAME END RESULT IS PRODUCED!

In practice, reversing entries will simplify the accounting process. For example, on the first payday following the reversing entry, a “normal” journal entry can be made to record the full amount of salaries paid as expense. This eliminates the need to give special consideration to the impact of any prior adjusting entry.

Reversing entries would ordinarily be appropriate for those adjusting entries that involve the recording of accrued revenues and expenses; specifically, those that involve future cash flows. Importantly, whether reversing entries are used or not, the same result is achieved!

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| When and why might reversing entries be used? |

| Are reversing entries mandatory? |

| Demonstrate, by example, the use of reversing entries, versus no reversing entries. |