The best run companies will minimize their investment in inventory. Inventory is costly and involves the potential for loss and spoilage. In the alternative, being out of stock may result in lost customers, so a delicate balance must be maintained. Careful attention must be paid to the inventory levels. One ratio that is often used to monitor inventory is the Inventory Turnover Ratio. This ratio shows the number of times that a firm’s inventory balance was turned (“sold”) during a year. It is calculated by dividing cost of sales by the average inventory level:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

If a company’s average inventory was $1,000,000, and the annual cost of goods sold was $8,000,000, one would deduce that inventory turned over 8 times (approximately once every 45 days). This could be good or bad depending on the particular business; if the company was a baker it would be very bad news, but a lumber yard might view this as good. So, general assessments are not in order. What is important is to monitor the turnover against other companies in the same line of business, and against prior years’ results for the same company. A declining turnover rate might indicate poor management, slow moving goods, or a worsening economy. In making such comparisons, one must be clever enough to recognize that the choice of inventory method affects the results.

Inventory Errors

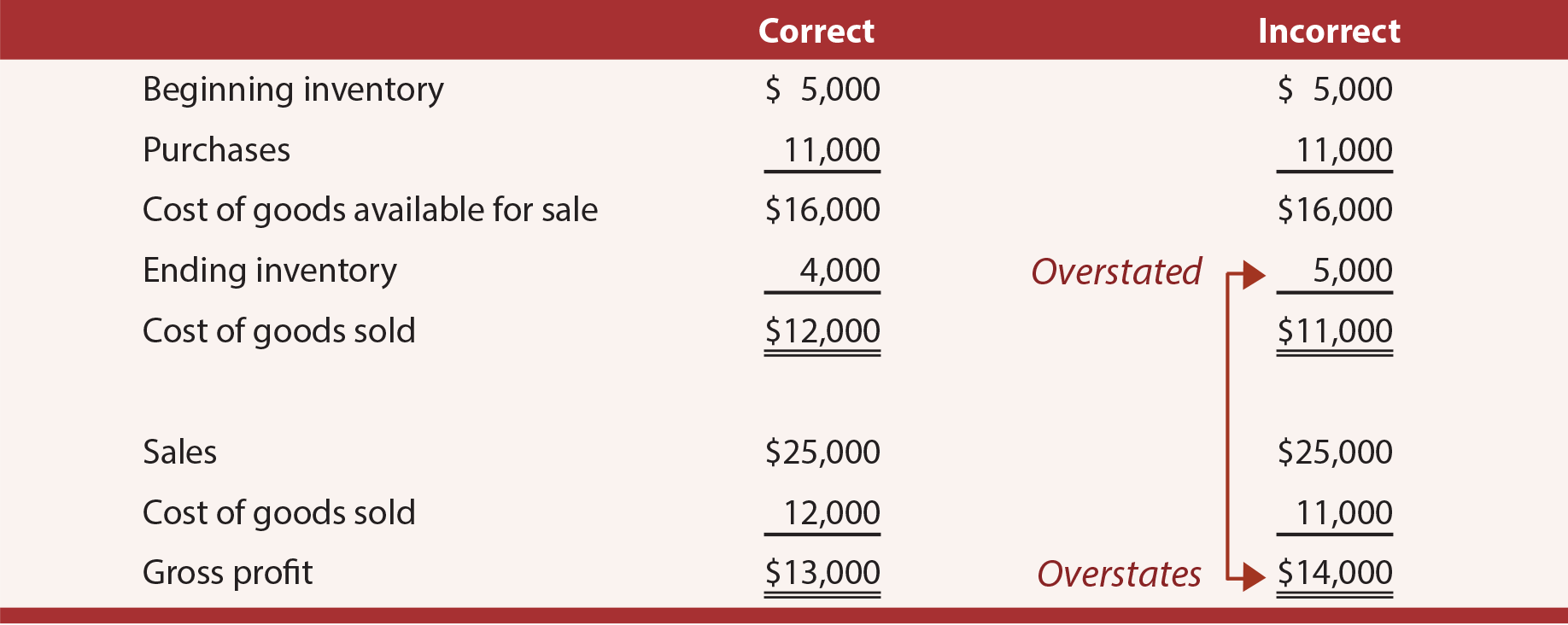

In the process of maintaining inventory records and the physical count of goods on hand, errors may occur. It is quite easy to overlook goods on hand, count goods twice, or simply make mathematical mistakes. It is vital that accountants and business owners fully understand the effects of inventory errors and grasp the need to be careful to get these numbers as correct as possible. A general rule is that overstatements of ending inventory cause overstatements of income, while understatements of ending inventory cause understatements of income. For instance, compare the following correct and incorrect scenario, where the only difference is an overstatement of ending inventory by $1,000 (note that this general rule is only valid when purchases are correctly recorded):

Had the above inventory error been an understatement ($3,000 instead of the correct $4,000), then the ripple effect would have caused an understatement of income by $1,000.

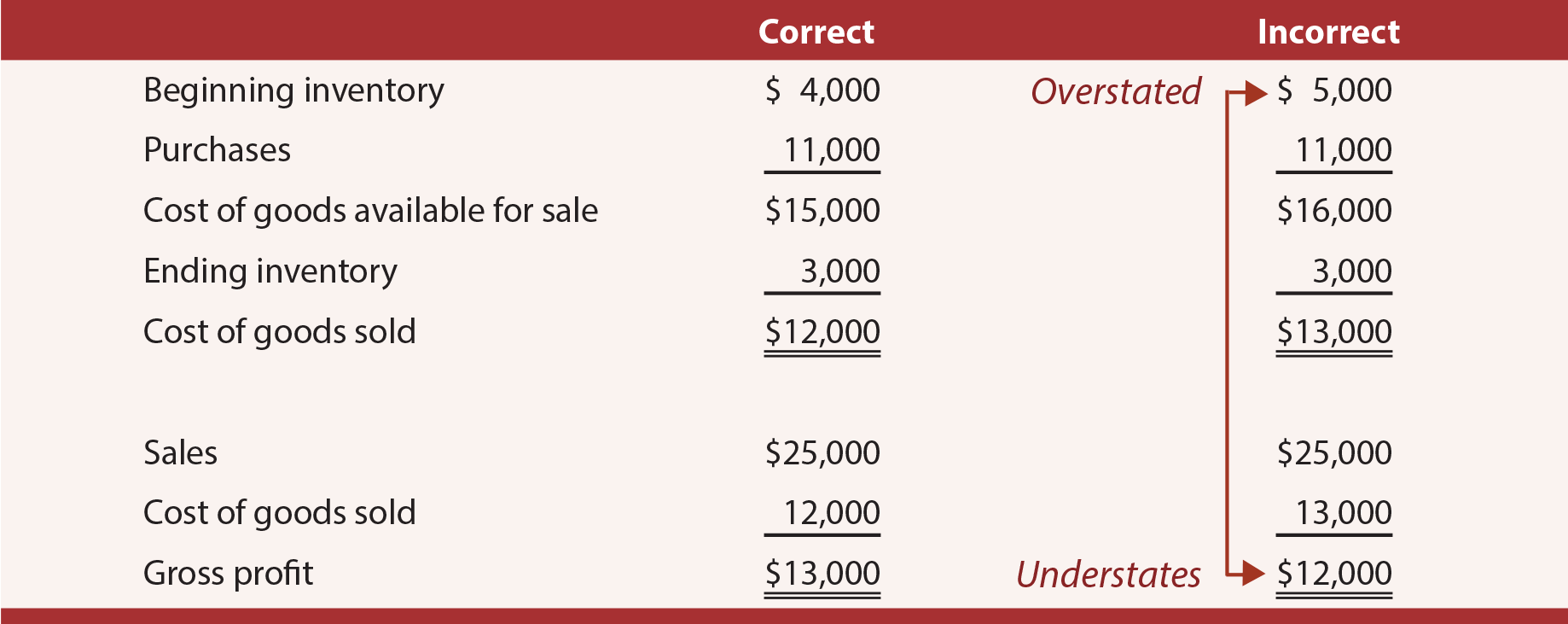

Inventory errors tend to be counterbalancing. That is, one year’s ending inventory error becomes the next year’s beginning inventory error. The general rule of thumb is that overstatements of beginning inventory cause that year’s income to be understated, and vice versa. Examine the following table where the only error relates to beginning inventory balances:

Hence, if the above illustrations related to two consecutive years, the total income would be correct ($13,000 + $13,000 = $14,000 + $12,000). However, the amount for each year is critically flawed.

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| Be able to calculate the inventory turnover ratio. |

| Understand the importance of managing inventory investment and activity. |

| Consider the impact of inventory errors, and note the effect of these errors on subsequent accounting periods. |