The table from the opening portion of this chapter distinguished between investments in debt securities and investments in equity securities. Attention is now turned to the specific details of accounting for investments in equity securities. Equity securities infer an ownership claim to the investor, and include investments in capital stock as well as options to acquire stock. The accounting method for an investment in equity securities primarily depends on the level of investment.

Most investments in equity securities are relatively small, giving the investor less than a 20% ownership stake. These investments are ordinarily insufficient to give the investor the right to control or significantly influence the investee company. The purposes for such smaller investments varies; suffice it to say that the end goal is usually to profit from price appreciation and dividends. Such investments may be short- or long-term in nature.

Short-term investments in equity securities were covered in Chapter 6, and that presentation is equally applicable to long-term investments. That is to say, the manner of accounting for short-term and long-term investments (those “generally below the 20% level”) does not vary. The investment is reported on the balance sheet at fair value, and changes in value are booked in income each period. The only notable difference is that the short-term investments would be presented in the current asset section of a balance sheet, while the longer-term investments would be positioned within the long-term investments category.

The Equity Method

An investor may acquire enough ownership in the stock of another company to permit the exercise of ”significant influence” over the investee company. For example, the investor has some direction over corporate policy and can sway the election of the board of directors and other matters of corporate governance and decision making. Generally, this is deemed to occur when one company owns more than 20% of the stock of the other. However, the ultimate decision about the existence of significant influence remains a matter of judgment based on an assessment of all facts and circumstances.

An investor may acquire enough ownership in the stock of another company to permit the exercise of ”significant influence” over the investee company. For example, the investor has some direction over corporate policy and can sway the election of the board of directors and other matters of corporate governance and decision making. Generally, this is deemed to occur when one company owns more than 20% of the stock of the other. However, the ultimate decision about the existence of significant influence remains a matter of judgment based on an assessment of all facts and circumstances.

Once significant influence is present, generally accepted accounting principles require that the investment be accounted for under the equity method. Market-value adjustments are usually not utilized when the equity method is employed. In global circles, the term “associate investment” might be used to describe equity method investments.

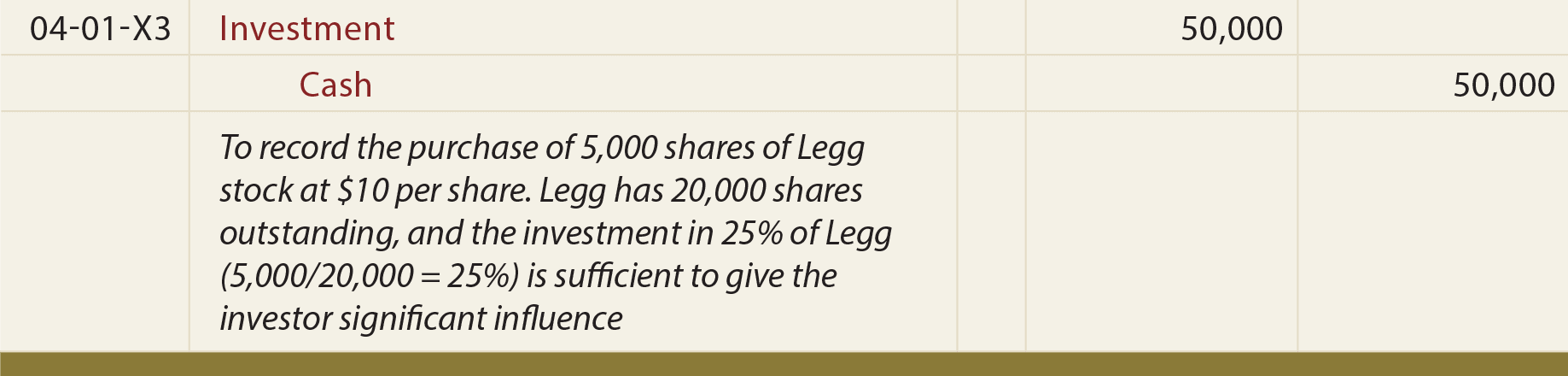

With the equity method, the accounting for an investment tracks the “equity” of the investee. That is, when the investee makes money (and experiences a corresponding increase in equity), the investor will record its share of that profit (and vice-versa for a loss). The initial accounting commences by recording the investment at cost:

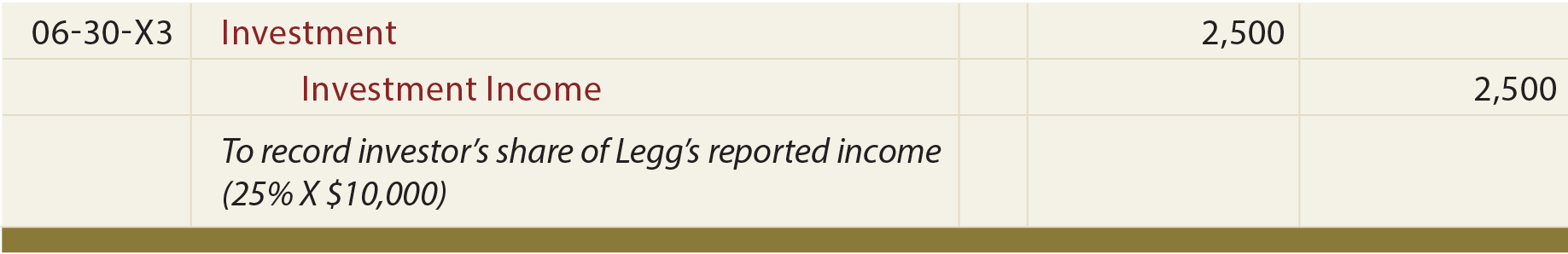

Next, assume that Legg reports income for the three-month period ending June 30, 20X3, in the amount of $10,000. The investor would simultaneously record its “share” of this reported income as follows:

Importantly, this entry causes the Investment account to increase by the investor’s share of the investee’s increase in its own equity (i.e., Legg’s equity increased $10,000, and the entry causes the investor’s Investment account to increase by $2,500), thus the name “equity method.” Notice, too, that the credit causes the investor to recognize income of $2,500, again corresponding to its share of Legg’s reported income for the period. Of course, a loss would be reported in the opposite fashion.

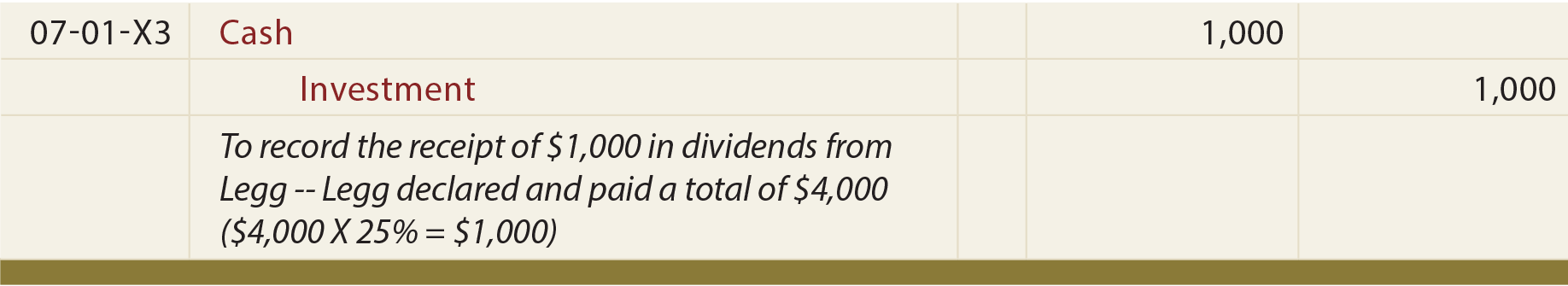

When Legg pays out dividends (and decreases its equity), the investor will need to reduce its Investment account as shown below.

The above entry is based on the assumption that Legg declared and paid a $4,000 dividend. This treats dividends as a return of the investment (not income, because the income is recorded as it is earned rather than when distributed). In the case of dividends, consider that the investee’s equity reduction is met with a corresponding proportionate reduction of the Investment account on the books of the investor.

| Did you learn? |

|---|

| Describe the equity method of accounting for an investment in stock, and be able to provide a comprehensive illustration. |

| What is the rationale for the equity method? |