Many associate the word “budget” with “dread” or “drudgery.” Perhaps the word “budget” should be avoided altogether. Words like “financial map” or “operational guide” might be suitable alternatives. No doubt, some employees will question the need for a budget. The process of budget preparation is sometimes seen as painful, and it is not always clear how the effort that is required leads to any productive output. Furthermore, budgets can be seen as imposing constraints that are hard to live with and establishing goals that are hard to meet!

Many associate the word “budget” with “dread” or “drudgery.” Perhaps the word “budget” should be avoided altogether. Words like “financial map” or “operational guide” might be suitable alternatives. No doubt, some employees will question the need for a budget. The process of budget preparation is sometimes seen as painful, and it is not always clear how the effort that is required leads to any productive output. Furthermore, budgets can be seen as imposing constraints that are hard to live with and establishing goals that are hard to meet!

Despite these dismal remarks, it is imperative that organizations carefully plan their financial affairs to achieve financial success. These plans are generally expressed as “budgets.” A budget is a detailed financial plan that quantifies future expectations and actions relative to acquiring and using resources.

Forms And Functions

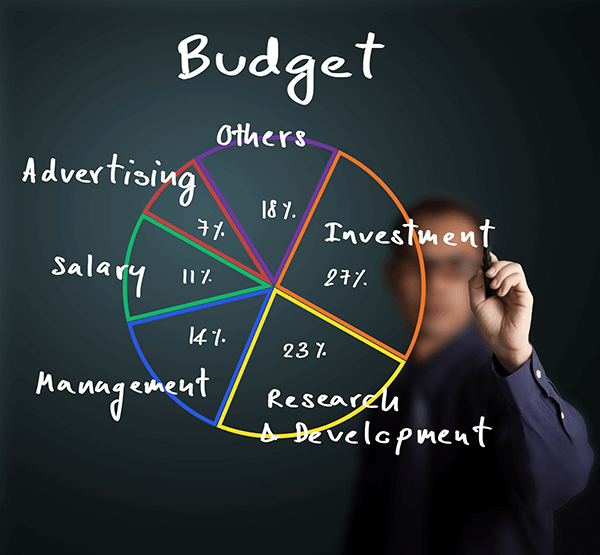

Budgets can take many forms and serve many functions, providing the basis for detailed sales targets, staffing plans, inventory production, cash investment/borrowing, capital expenditures (for plant assets, etc.), and so on. Budgets provide benchmarks against which to compare actual results and develop corrective measures; give managers “preapproval” for execution of spending plans; and allow managers to provide forward-looking guidance to investors and creditors. Budgets are necessary to persuade banks and other lenders to extend credit. This chapter will illustrate the master budget, which is a comprehensive set of documents specifying sales targets, production activities, and financing actions. These documents lead to forward-looking financial statements (e.g., projected balance sheet). Other types of budgets (e.g., flexible budgets) are covered in subsequent chapters.

Avoiding Business Chaos

In small organizations, formal budgets are a rarity. The individual owner/manager likely manages only by reference to a general mental budget. The person has a good sense of expected sales, costs, financing, and asset needs. Each transaction is under direct oversight of this person and hopefully he or she has the ability to keep things on a logical course. When things don’t go well, the owner/manager can usually take up the slack by not taking a paycheck or engaging in some other form of financial hardship. Of course, many small businesses ultimately fail anyway. Explanations for failure are many and varied, but are often pinned on “undercapitalization” or “insufficient resources to sustain operations.” Many of these postmortem assessments reflect a failure to adequately plan! Even in a small business, an authentic business plan/budget can often result in anticipating and avoiding disastrous outcomes.

Medium and larger organizations invariably rely on budgets. This is equally true in business, government, and not-for-profit organizations. The budget provides a formal quantitative expression of expectations. It is an essential facet of the planning and control process. Without a budget, an organization will be highly inefficient and ineffective.

Budgeting Case Study

Imagine that one has just been appointed as general manager of a newly constructed power plant. Compensation and ultimately the manager’s job will depend on the financial success of the venture. The manager would try to quickly get a handle on the business. How many customers will be served? What are the peak electricity loads? What rate can be charged and will it be enough to cover expenses? How much fuel will be necessary to produce the electricity? Will the cash supply always be sufficient to meet needs? Furthermore, how will actions be executed and controlled?

Imagine that one has just been appointed as general manager of a newly constructed power plant. Compensation and ultimately the manager’s job will depend on the financial success of the venture. The manager would try to quickly get a handle on the business. How many customers will be served? What are the peak electricity loads? What rate can be charged and will it be enough to cover expenses? How much fuel will be necessary to produce the electricity? Will the cash supply always be sufficient to meet needs? Furthermore, how will actions be executed and controlled?

Perhaps the above is too much to deal with. Instead the manager could spend time only on marketing and personnel management. These efforts might sell a lot of electricity. Unfortunately, sales growth could be such that the natural gas pipeline cannot deliver enough fuel to meet the plant’s demand. More expensive fuel oils might need to be trucked in to produce the electricity. Suppliers might become concerned, as they sense that revenues might be inadequate to cover the added fuel cost. As a result, vendors might begin to insist on shortened payment terms, thereby pressuring the company’s cash supply. To solve this problem, it could become necessary to reduce the workforce. A downward spiral might ensue.

Rewind this unfortunate scenario, this time utilizing a plan. Careful studies are performed to determine the most efficient levels of production for the plant, in conjunction with an assessment of customer demand. The expected sales are translated into a schedule of expected daily electricity production. Based on this information, long-term supply contracts are negotiated for natural gas supplies. Staffing plans are developed that optimize the number of employees and their work times. Contingency plans are developed for a variety of scenarios. Periods during which cash might be tight are noted and a line of credit is set up with a local bank to cover those periods. All of these activities lead to a projected outcome.

Rewind this unfortunate scenario, this time utilizing a plan. Careful studies are performed to determine the most efficient levels of production for the plant, in conjunction with an assessment of customer demand. The expected sales are translated into a schedule of expected daily electricity production. Based on this information, long-term supply contracts are negotiated for natural gas supplies. Staffing plans are developed that optimize the number of employees and their work times. Contingency plans are developed for a variety of scenarios. Periods during which cash might be tight are noted and a line of credit is set up with a local bank to cover those periods. All of these activities lead to a projected outcome.

Once the plan is in place, individuals will be authorized to act consistent with the plan. The entire team will steer toward an expected outcome. The manager will monitor operations and take corrective actions for deviations from the plan. The remainder of his time can be spent on public relations marketing, employee interaction, and so forth.

Benefits Of Budgeting

Budgets don’t guarantee success, but they certainly help to avoid failure. The budget is an essential tool to translate general plans into specific, action-oriented goals and objectives. By adhering to the budgetary guidelines, the expectation is that the identified goals and objectives can be fulfilled.

It is crucial to remember that a large organization consists of many people and parts. These components need to be orchestrated to work together in a cohesive fashion. The budget is the tool that communicates the expected outcome and provides a detailed script to coordinate all of the individual parts to work in concert.

When things don’t go as planned, the budget is the tool that provides a mechanism for identifying and focusing on departures from the plan. The budget provides the benchmarks against which to judge success or failure in reaching goals and facilitates timely corrective measures.

Operations and responsibilities are normally divided among different segments and managers. This introduces the concept of “responsibility accounting.” Under this concept, units and their managers are held accountable for transactions and events under their direct influence and control.

Budgets should provide sufficient detail to reflect anticipated revenues and costs for each unit. This philosophy pushes the budget down to a personal level, and mitigates attempts to pass blame to others. Without the harsh reality of an enforced system of responsibility, an organization will quickly become less efficient. Deviations do not always suggest the need for imposition of penalties. Poor management and bad execution are not the only reasons things don’t always go according to plan. But, deviations should be examined and unit managers need to explain/justify them.

Budgets should provide sufficient detail to reflect anticipated revenues and costs for each unit. This philosophy pushes the budget down to a personal level, and mitigates attempts to pass blame to others. Without the harsh reality of an enforced system of responsibility, an organization will quickly become less efficient. Deviations do not always suggest the need for imposition of penalties. Poor management and bad execution are not the only reasons things don’t always go according to plan. But, deviations should be examined and unit managers need to explain/justify them.

Within most organizations it becomes very common for managers to argue and compete for allocations of limited resources. Each business unit likely has employees deserving of compensation adjustments, projects needing to be funded, equipment needing to be replaced, and so forth. This naturally creates strain within an organization, as the sum of the individual resource requests will usually be greater than the available pool of funds. Successful managers will learn to make a strong case for the resources needed by their units.

Within most organizations it becomes very common for managers to argue and compete for allocations of limited resources. Each business unit likely has employees deserving of compensation adjustments, projects needing to be funded, equipment needing to be replaced, and so forth. This naturally creates strain within an organization, as the sum of the individual resource requests will usually be greater than the available pool of funds. Successful managers will learn to make a strong case for the resources needed by their units.

But, successful managers also understand that their individual needs are subservient to the larger organizational goals. Once the plan for resource allocation is determined, a good manager will support the overall plan and move ahead to maximize results for the overall entity. Personal managerial ethics demands loyalty to an ethical organization, and success requires teamwork. Here, the budget process is the device by which the greater goals are mutually agreed upon, and the budget reflects the specific strategy that is to be followed in striving to reach those goals. Without a budget, an organization can be destroyed by constant bickering about case-by-case resource allocation decisions.

Another advantage of budgets is that they can be instrumental in identifying constraints and bottlenecks. The earlier example of the power plant well illustrated this point. Efficient operation of the power plant was limited by the supply of natural gas. A carefully developed budget will always consider capacity constraints. Managers can learn well in advance of looming production and distribution bottlenecks. Knowledge of these sorts of potential problems is the first step to resolving or avoiding them.

| Did you learn? |

|---|

| Define the term “budget.” |

| Cite the benefits of the budgeting process. |