It is virtually impossible to develop a listing of every type of business decision that will be confronted. Classic examples include whether or not to outsource, when to accept special orders, and whether to discontinue a product or project. Although each of these examples will be considered in more detail, it is most important to develop a general frame of reference for business decision making.

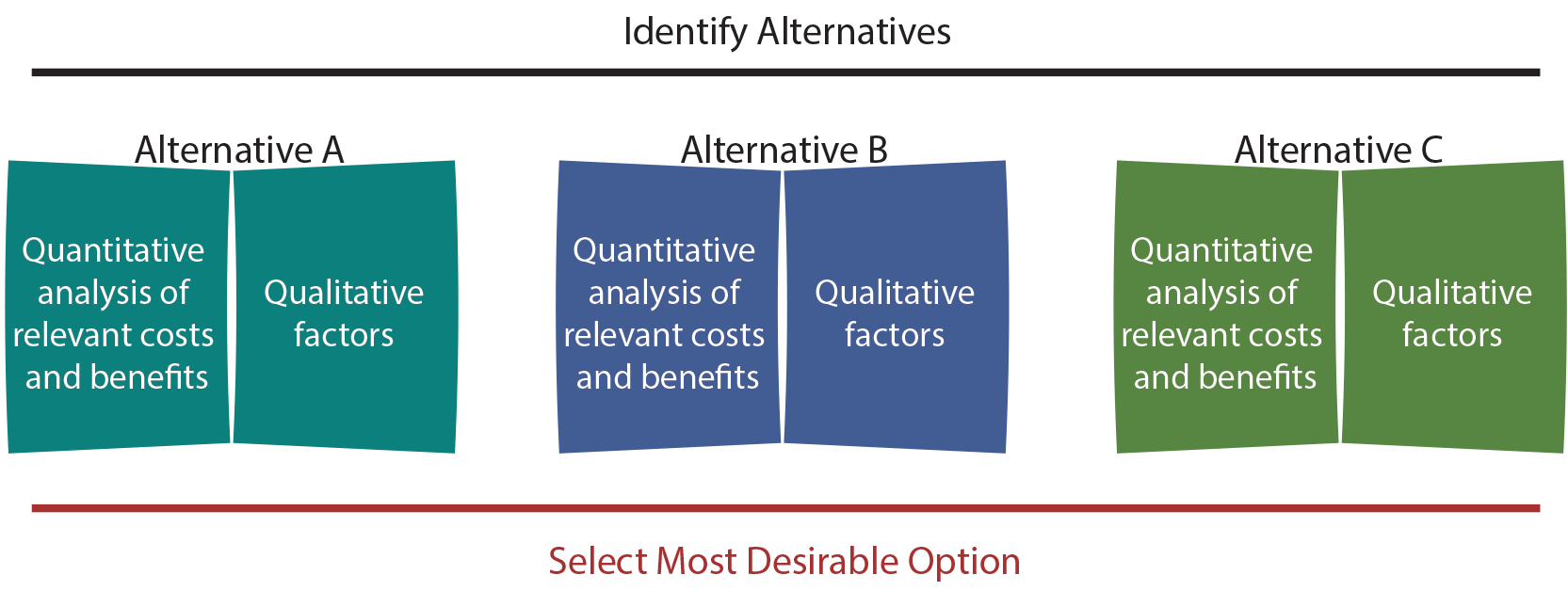

In general, business decision making requires identification of decision alternatives, logging relevant costs/benefits of each choice, evaluating qualitative issues, and selecting the most desirable option based on judgmental balancing of quantitative and qualitative factors. Recognize that this process begins with judgment (what are the alternatives?) and ends with judgment (which alternative presents the best blend of quantitative and qualitative factors?).

Outsourcing

Companies must frequently choose between using outside vendors/suppliers or producing a good or service internally. Outsourcing occurs across many functional areas. For instance, some companies outsource data processing, tech support, payroll services, and similar operational aspects of running a business. Manufacturing companies may also find it advantageous to outsource certain aspects of production (frequently termed the “make or buy” decision).

Further, some companies (e.g., certain high-profile sporting apparel companies) have broad product lines, but actually produce no tangible goods. They instead focus on branding/marketing and outsource all of the actual manufacturing. Outsourcing has been around for decades, but it has received increased media/political attention with the increase in global trade. Tax, regulation, and cost factors can vary considerably from one global region to another. As a result, companies must constantly assess the opportunities for improved results via outsourcing.

Further, some companies (e.g., certain high-profile sporting apparel companies) have broad product lines, but actually produce no tangible goods. They instead focus on branding/marketing and outsource all of the actual manufacturing. Outsourcing has been around for decades, but it has received increased media/political attention with the increase in global trade. Tax, regulation, and cost factors can vary considerably from one global region to another. As a result, companies must constantly assess the opportunities for improved results via outsourcing.

The outsourcing decision process should include an analysis of all relevant costs and benefits. Items that differ between the “make” alternative and the “buy” alternative should be studied. As usual, avoid the temptation to consider sunk costs as part of the decision analysis.

Generally, one would compare the variable production/manufacturing cost of a service/product with the purchase price of the service/product. Unless the outsourcing option results in a complete elimination of a factory or facilities, the fixed overhead is apt to continue whether the service/product is purchased or produced. As a result, unavoidable fixed overhead does not vary between the alternatives and can be disregarded. On the other hand, if some fixed factory overhead can be avoided by outsourcing, it should be taken into consideration as a relevant item.

Case Study

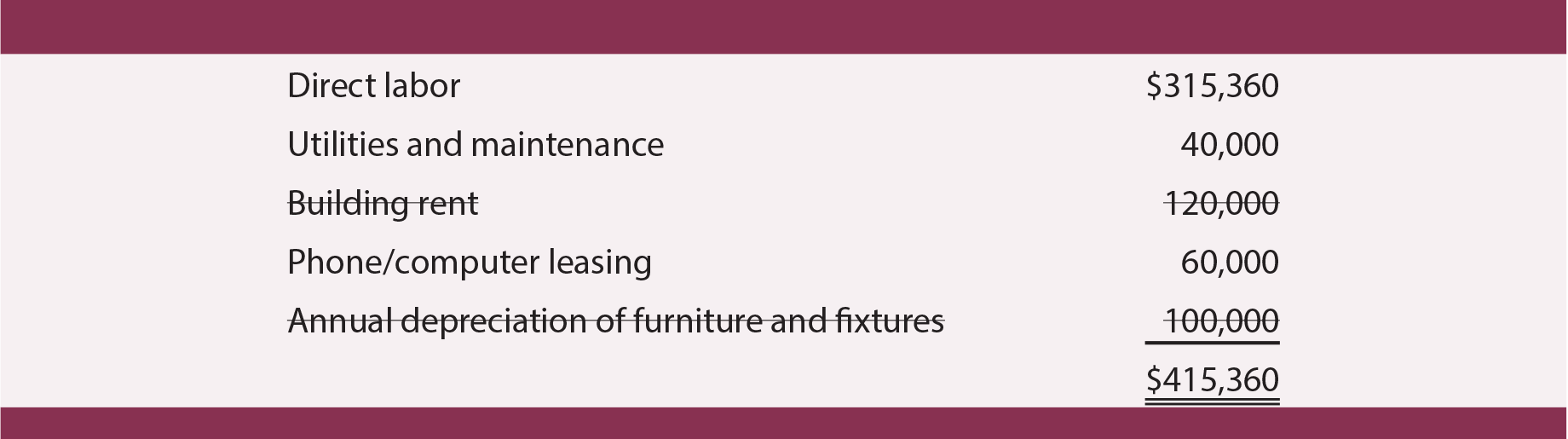

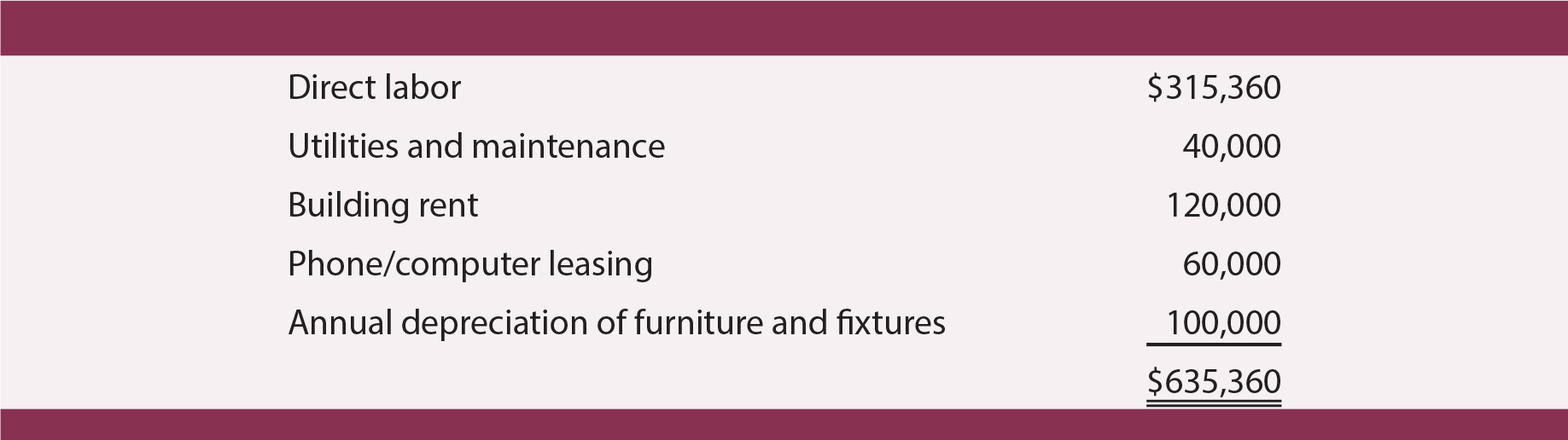

Pilot Corporation produces software for handheld global positioning systems. The software provides a robust tool for navigational support and mapping. It is used by airline pilots, mariners, and others. Because these applications are often of critical importance, Pilot maintains a tech support department that is available around the clock to answer questions. The annual budget for the tech support department is shown below.

Direct labor to staff the tech support department consists of 3 persons always available during each 8-hour shift, at an hourly rate of $12 per hour (3 persons per shift X 8 hours per shift X 3 shifts per day X 365 days per year X $12 per hour = $315,360). The utilities and maintenance are fixed, but would be avoided if the unit were shut down. The building is leased under a long-term contract, and the rent is unavoidable. Phone and computer equipment are leased under a flat-rate contract, but the agreement is cancelable without penalty. The annual depreciation charge on furniture and fixtures reflects a cost allocation of expenditures made in prior years.

Pilot has been approached by Chandra Corporation, a leading provider of independent tech support services, to provide a turn-key tech support solution at the rate of $12 per support event. Pilot estimates that it generates about 50,000 support events per year. Chandra’s proposal to Pilot notes that the total expected cost of $600,000 (50,000 events X $12 per event) is less than the $635,360 currently budgeted for tech support. However, a correct analysis for Pilot focuses only on the relevant items (following). Even if Chandra is engaged to provide the support services, building rent will continue to be incurred (it is not relevant to the decision). The cost of furniture and fixtures is a sunk cost (it is not relevant to the decision). The total cost of relevant items is much less than the $600,000 indicated by Chandra’s proposal. Therefore, the quantitative analysis suggests that Pilot should continue to provide its own tech support in the near future. After all, why spend $600,000 to avoid $415,360 of cost? Once the building lease matures, when the furniture and fixtures are in need of replacement, or if tech support volume drops off, Chandra’s proposal might be worthy of reconsideration.

Capacity Issues

Outsourcing analysis is made more complicated if a business is operating at capacity. If outsourcing will free up capacity to be used on other services or products, then the contribution margin associated with the additional services or products also becomes a relevant item in the decision process. In other words, if a company continues to manufacture a product in lieu of outsourcing, it foregoes the chance to produce the alternative product. The loss of this opportunity has a cost that must be considered in the final decision. Accountants (and economists and others) may use the term opportunity cost to describe the cost of foregone opportunities. It is appropriate to factor opportunity costs into any outsourcing analysis.

Outsourcing analysis is made more complicated if a business is operating at capacity. If outsourcing will free up capacity to be used on other services or products, then the contribution margin associated with the additional services or products also becomes a relevant item in the decision process. In other words, if a company continues to manufacture a product in lieu of outsourcing, it foregoes the chance to produce the alternative product. The loss of this opportunity has a cost that must be considered in the final decision. Accountants (and economists and others) may use the term opportunity cost to describe the cost of foregone opportunities. It is appropriate to factor opportunity costs into any outsourcing analysis.

Case Study

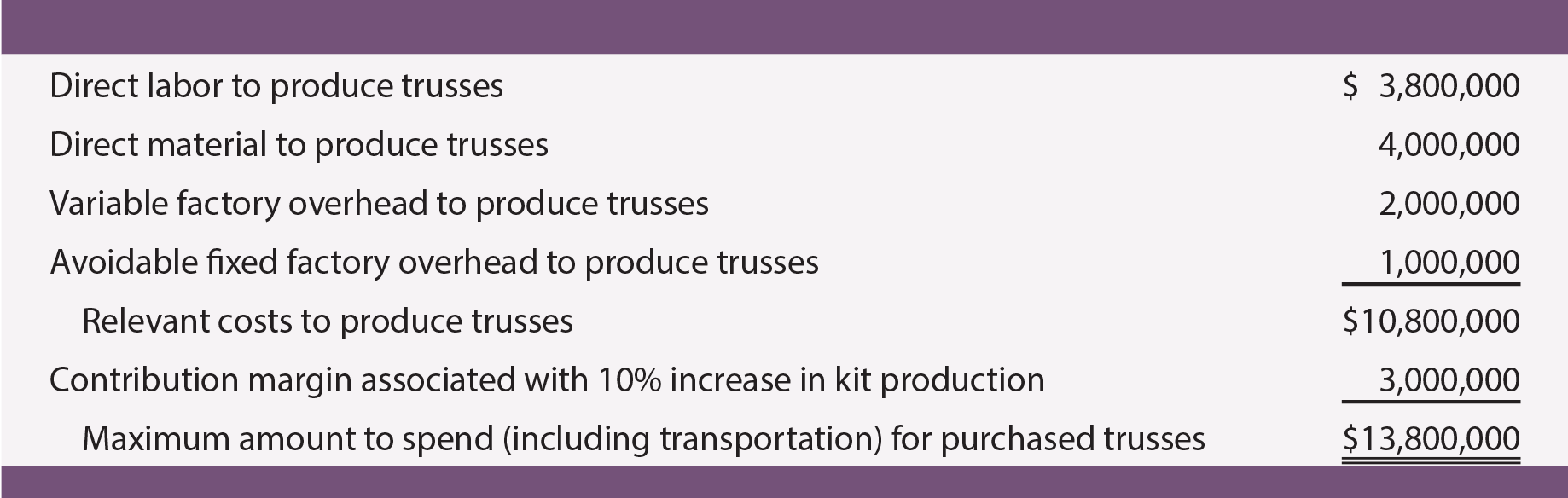

Mueller Building Systems manufactures customized steel components that are sold in kits for the do-it-yourself rancher. The kits include all of the parts necessary to easily construct metal barns of various shapes and sizes. Mueller’s products are very popular, and its U.S. manufacturing plants have been running at full capacity.

In an effort to free up capacity, Mueller contracted with Zhang Manufacturing of China to produce all roof truss components to be included in the final kits. The capacity that was released by the outsourcing decision enabled a 10% increase in the total number of kits that were produced and sold. Mueller’s accounting department prepared the following analysis that was used as a basis for negotiating the contract with Zhang:

Notice that the analysis reveals that Mueller Building Systems will reduce costs by only $10,800,000 via outsourcing, but can easily spend more than this on purchasing the same units from Zhang. This results because the freed capacity will be used to produce additional contribution margin that would otherwise be foregone.

One must be very careful to fully capture the true cost of outsourcing. Oftentimes, the costs of placing and tracking orders, freight, customs fees, commissions, or other costs can be overlooked in the analysis. Likewise, if outsourcing results in employee layoffs, expect increases in unemployment taxes, potential acceleration of pension costs, and other costs that should not be ignored in the quantitative analysis. Finally, a situation like that faced by Mueller may indicate the need for additional capital expenditures to increase overall capacity.

Qualitative Issues

Companies must be very careful to consider qualitative issues in making decisions about outsourcing. Outsourcing places quality control, production scheduling, and similar issues in the hands of a third party. One must continually monitor the supplier’s financial health and ability to continue to deliver quality products on a timely basis. If goods are being moved internationally, goods may be subject to high freight costs, customs fees, taxes, and other costs. Delays are often associated with the uncertain logistics of moving goods through brokers, large sea ports, and homeland security inspections.

Companies must be very careful to consider qualitative issues in making decisions about outsourcing. Outsourcing places quality control, production scheduling, and similar issues in the hands of a third party. One must continually monitor the supplier’s financial health and ability to continue to deliver quality products on a timely basis. If goods are being moved internationally, goods may be subject to high freight costs, customs fees, taxes, and other costs. Delays are often associated with the uncertain logistics of moving goods through brokers, large sea ports, and homeland security inspections.

Hopefully rare, but not to be ignored, are risks associated with relying on suppliers in politically unstable environments; significant disruptions are not without precedent. Language barriers can be problematic. Although global trade is increasingly reliant on English, there are still many miscues brought about by a failure to have full and complete communication.

Additionally, some global outsourcing can be met with customer resistance. Examples include frustrations with call centers and tech support lines where language barriers become apparent, and customer protest/rejection because of perceived unfair labor practices in certain global regions. Despite the potential problems, there are decided trends suggesting that the most successful businesses learn to utilize logical outsourcing opportunities in both local and global markets.

Special Orders

A business may receive a special order at a price that is significantly different from the normal pricing scheme. The quantitative analysis will focus on the contribution margin associated with the special order. In other words, it must be determined whether the special order sales price exceeds the variable production and selling costs associated with the special order.

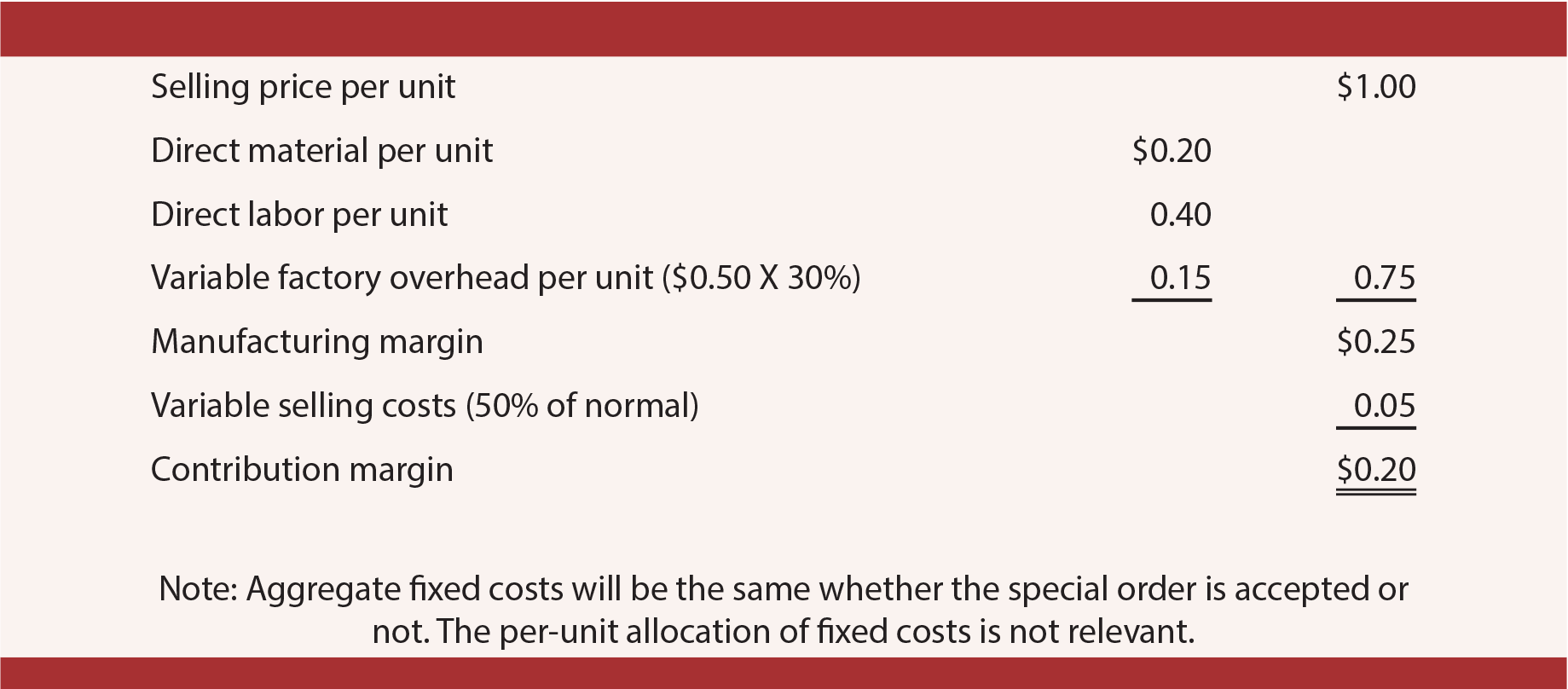

To illustrate, assume that Lunker Lures Company produces the popular Rippin’ Rogue. The “cost” to produce a Rippin’ Rogue is $1.10, consisting of $0.20 direct materials, $0.40 direct labor, and $0.50 factory overhead. The overhead is 30% variable and 70% fixed cost allocation. Rippin’ Rogues are sold to retailers across the country through an established network of manufacturers’ representatives who are paid $0.10 for each lure sold in their respective territories.

To illustrate, assume that Lunker Lures Company produces the popular Rippin’ Rogue. The “cost” to produce a Rippin’ Rogue is $1.10, consisting of $0.20 direct materials, $0.40 direct labor, and $0.50 factory overhead. The overhead is 30% variable and 70% fixed cost allocation. Rippin’ Rogues are sold to retailers across the country through an established network of manufacturers’ representatives who are paid $0.10 for each lure sold in their respective territories.

Lunker Lures has been approached by Walleye Pro Fishing World to produce a special run of 1,000,000 units. These lures would be sold under the Walleye Wiggler brand name and would not otherwise compete with sales of Rippin’ Rogues. Walleye Pro Fishing World’s offer is priced at $1.00 per unit. Lunker Lures is obligated to pay its representatives half of the normal rep fee for such private label transactions.

On the surface it appears that Lunker Lures should not accept this order. After all, the offer is priced below the noted cost of production. However, so long as Walleye Wigglers do not compete with sales of Rippin’ Rogues, and Lunker Lures has enough capacity to produce lures without increasing fixed costs, profit will be enhanced by $200,000 ($0.20 X 1,000,000) by accepting the order. The following analysis focuses on the relevant items in reaching this conclusion:

Capacity Constraints

A potential error in special order pricing is acceptance of special orders offering the highest contribution margin per dollar of sales, while ignoring capacity constraints. Notice that the special order for Walleye Wigglers offered a 20% contribution margin ($0.20/$1.00). Suppose Fishing Town also placed a special order for a Bass Buzzer lure, and that special order afforded a 30% margin on a $1.00 per unit selling price.

At first glance, one would assume that the Fishing Town order would represent the better choice. But, what if one were also informed that remaining plant capacity would allow production of either 1,000,000 Walleye Wigglers or 600,000 Bass Buzzers? Now, the total contribution margin on the Wiggler is $200,000 (1,000,000 units X $0.20) while the total contribution on the Buzzer is $180,000 (600,000 X 30%).

At first glance, one would assume that the Fishing Town order would represent the better choice. But, what if one were also informed that remaining plant capacity would allow production of either 1,000,000 Walleye Wigglers or 600,000 Bass Buzzers? Now, the total contribution margin on the Wiggler is $200,000 (1,000,000 units X $0.20) while the total contribution on the Buzzer is $180,000 (600,000 X 30%).

The better choice is to go with the Wiggler, as that option maximizes the total contribution margin. This important distinction gives consideration to the fact that producing a few units (with a high per-unit contribution margin) may be less profitable than producing many units (with a low per-unit contribution margin). Contribution margin analysis should never be divorced from consideration of factors that limit its generation.

Discontinue A Product Or Department

It is difficult to decide when to abandon a business unit that is performing poorly. Such decisions can have far-reaching effects on the company, shareholders, employees, and suppliers. What analytical methods should be employed to support a final decision to discontinue a business unit?

Management should not merely conclude that any unit generating a net loss is to be eliminated. This is an all-too-common error made by those who lack sufficient accounting knowledge. Sometimes, eliminating a unit with a loss can actually reduce overall performance.

Consider that some fixed costs identified with a discontinued unit may continue and must be absorbed by other units. This creates a potential domino effect where each failing unit pushes down the next. Instead, the appropriate analysis is to compare company-wide net income “with” and “without” the unit targeted for elimination.

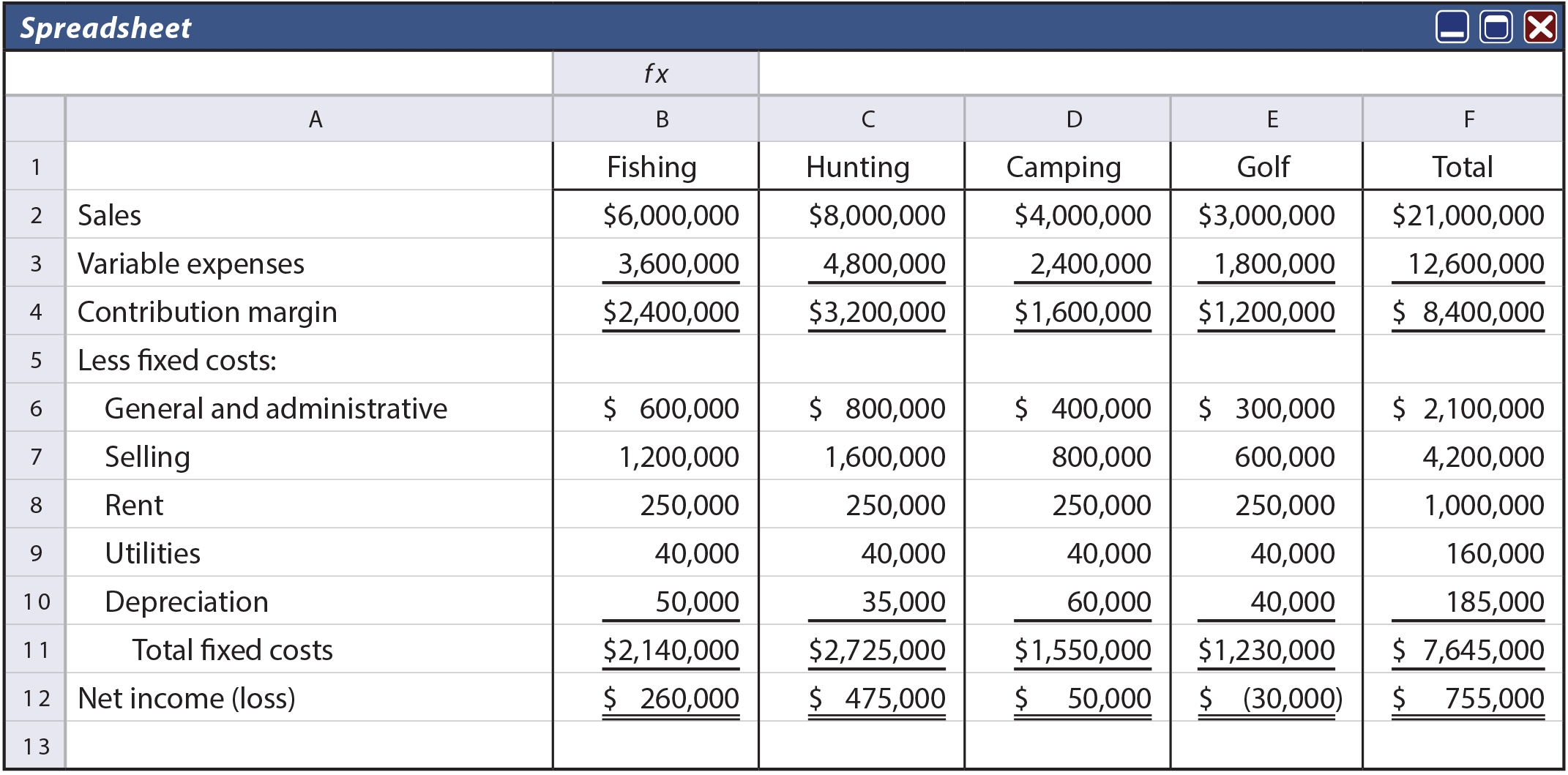

Casa de Deportes is a mega sporting goods store occupying 80,000 square feet of space in a rented retail center. Each department is evaluated for profitability based on the following information:

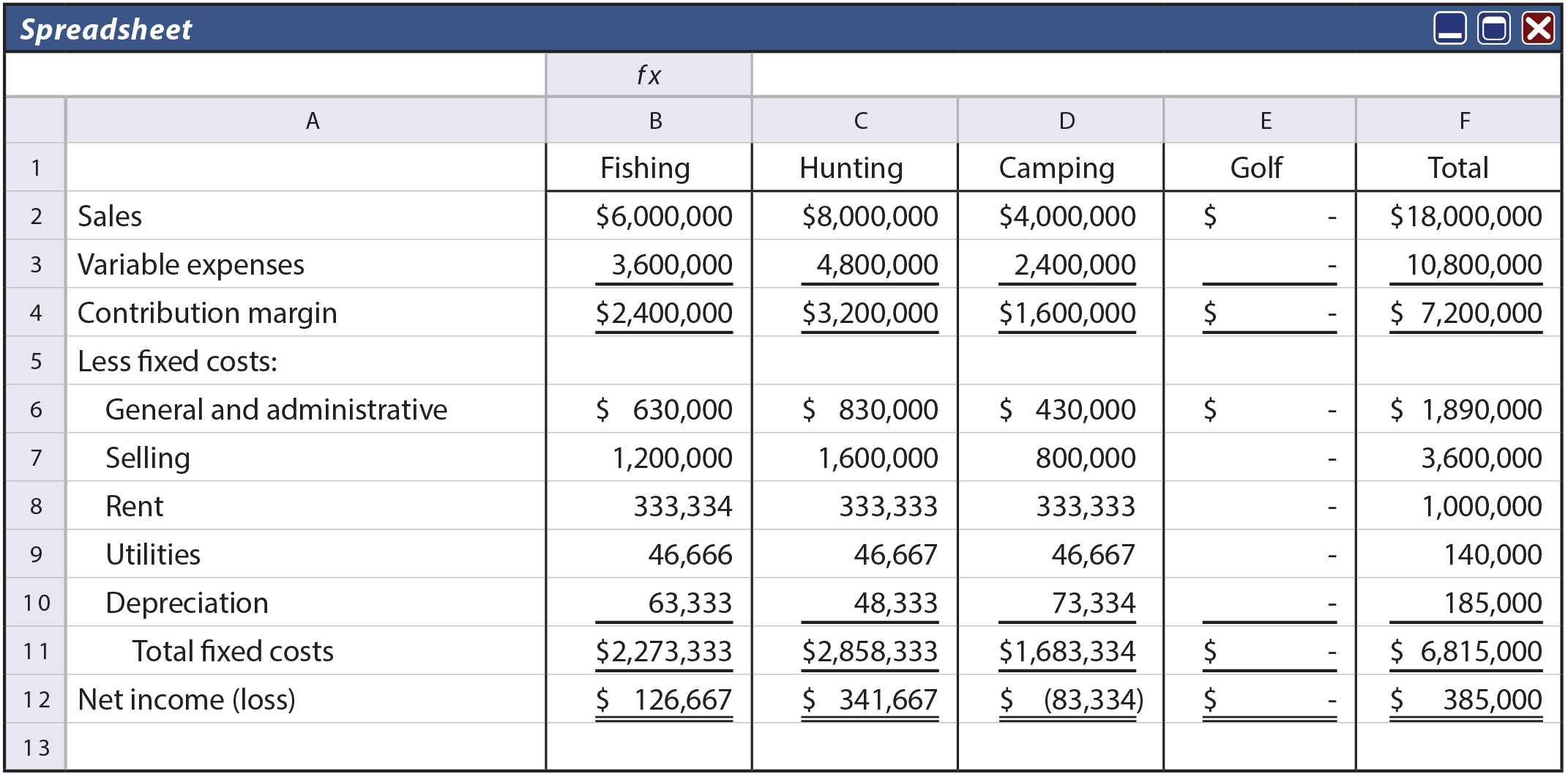

Management is concerned about the Golf Department. If Golf is discontinued, only 70% of the general and administrative costs would be eliminated, rent and depreciation would continue to be incurred, and utilities would be reduced by only half. The selling costs would be completely eliminated. The unavoidable costs are shifted equally to the other departments (although other allocation methods could be used, the overall conclusions would not change). The income report “without golf” appears as follows:

Discontinuing Golf will not help. The reallocation of unavoidable costs not only reduces overall profitability, but it also moves Camping in a precarious direction. Further, this analysis does not take into account potential sales reductions in other departments that might occur from reductions in overall store traffic or incremental costs from closing a department (e.g., inventory write-offs). The decision to discontinue a product, department, or project can become quite complex.

The 80/20 Concept

A business may have a broad product line and large customer base. However, a significant portion of its success may be centered around a narrow set of products, customers, and services. As a result, it may prove beneficial to adopt the 80/20 concept.

The 80/20 business process focuses on what is most important (the 20% of the items that account for 80% of the value) and spends less effort on low-value drivers. The 80/20 process is used to simplify and focus on key parts of a business and reduce complexity that can often disguise what is most important.

Some contend that this approach results in sacrificing long-term opportunities to enhance short-term profitability. For instance, a “small and inexperienced” customer that is abandoned today might eventually grow to be a major player. As a result, the 80/20 philosophy is not always the optimum strategy, and good business judgment should always be exercised in the decision-making process.

| Did you learn? |

|---|

| Describe the steps in the general approach to decision making. |

| In addition to quantitative factors, what else should be considered in the decision making process? |

| Be able to perform calculations related to outsourcing decisions (“make or buy”). |

| Define “opportunity cost” and note its importance in the decision process. |

| Be able to perform calculations for special order pricing decisions. |

| Know why the contribution margin must be analyzed in terms of capacity constraints. |

| Be able to perform calculations for addition or deletion of products (or departments) in decision making. |

| Know the 80/20 concept. |