Virtually everyone can think of things they wish they could do over. Mistakes and fumbled execution seem to be unavoidable. Business persons experience similar feelings. Perhaps inventory was shipped using costly overnight express when less-expensive ground shipping would have worked as well. Perhaps parking lot lights were unnecessarily left on during daylight hours. Hundreds of examples can be cited, and management must be diligent to control against these types of business execution errors.

Virtually everyone can think of things they wish they could do over. Mistakes and fumbled execution seem to be unavoidable. Business persons experience similar feelings. Perhaps inventory was shipped using costly overnight express when less-expensive ground shipping would have worked as well. Perhaps parking lot lights were unnecessarily left on during daylight hours. Hundreds of examples can be cited, and management must be diligent to control against these types of business execution errors.

Earlier chapters discussed numerous methods for monitoring and controlling against waste. Remember, each dollar of wasted expense comes right off the bottom line. For a public company that is valued based on a multiple of reported income, a dollar wasted can translate into many times that in lost market value.

On a broader scale, business plans and decisions might be faulty from the outset. There is really no excuse for stepping into a business plan when it has little or no chance for success. This is similar to going into a tough exam without preparing. Regret is perhaps the only lasting outcome.

The overall theme of this chapter is to impart knowledge about sound principles and methods that can be employed to make sound business decisions. These techniques won’t eliminate execution errors, but they will help avoid many of the judgment errors that are all too common among failing businesses.

Sunk Costs

One of the first things to understand about sound business judgment is that a distinction must be made between sunk costs and relevant costs. There is an old adage that cautions against “throwing good money after bad.” This has to do with the concept of a sunk cost, and it is an appropriate warning.

A sunk cost relates to the historical amount that has already been expended on a project or object. For example, one may have purchased an expensive shirt that was hopelessly shrunk in the dryer. There would be no reason to buy a matching pair of pants because so much was invested in the shirt. The amount previously spent on the shirt is no longer relevant; it is a sunk cost and should not influence future actions.

Relevant Costs

In business decision making, sunk costs should be ignored. Instead, the focus should be on relevant costs. Relevant items are future costs and revenues expected to differ among the alternative decisions under consideration. The objective is to identify the decision yielding the best incremental outcome as it relates to relevant costs/benefits.

Case Study

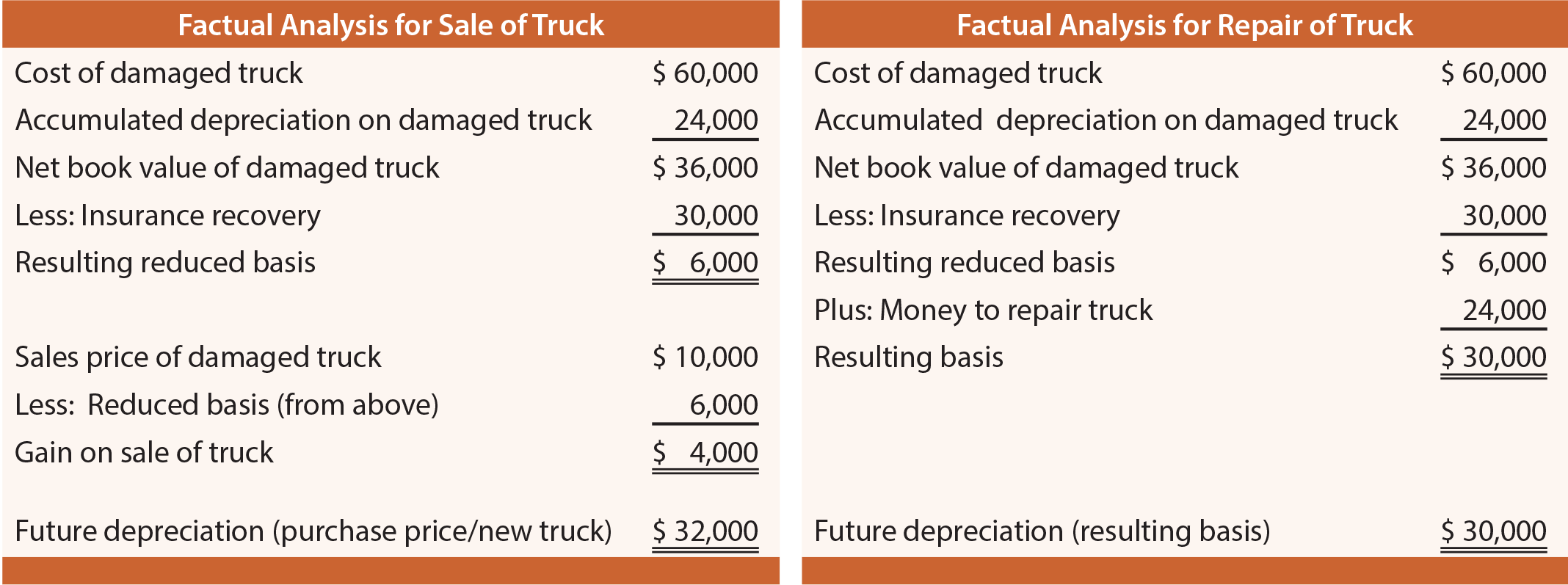

During a recent ice storm, Dillaway Company’s delivery truck was involved in a traffic accident. The truck originally cost $60,000, and was 40% depreciated. An insurance company has provided Dillaway $30,000 for the damages that were incurred. Dillaway took the truck to a local dealer who offered two options: (a) repair the truck for $24,000 or (b) buy the truck “as is, where is” for $10,000. Dillaway has found an undamaged, but otherwise identical, used truck for sale on the internet for $32,000. What decision is in order?

The truck’s cost of $60,000 is sunk and irrelevant. The degree to which it is depreciated is equally irrelevant. The financial statement “gain” reported on a sale is irrelevant. The $30,000 received from insurance is the same whether the truck is sold or repaired; because it does not vary between the two alternatives, it is irrelevant (i.e., it is not necessary to consider it in the decision process). All that matters is that the truck can be repaired for $24,000, or the truck can be sold for $10,000 and a similar one purchased for $32,000. In the former case, Dillaway is back in operation for $24,000; in the later, Dillaway is back in operation for $22,000 ($32,000 – $10,000). It seems clear that the better option is to sell the damaged truck.

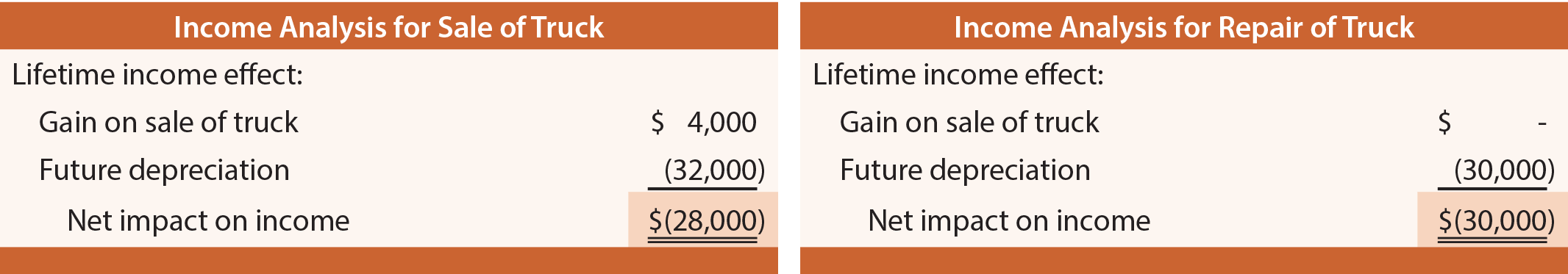

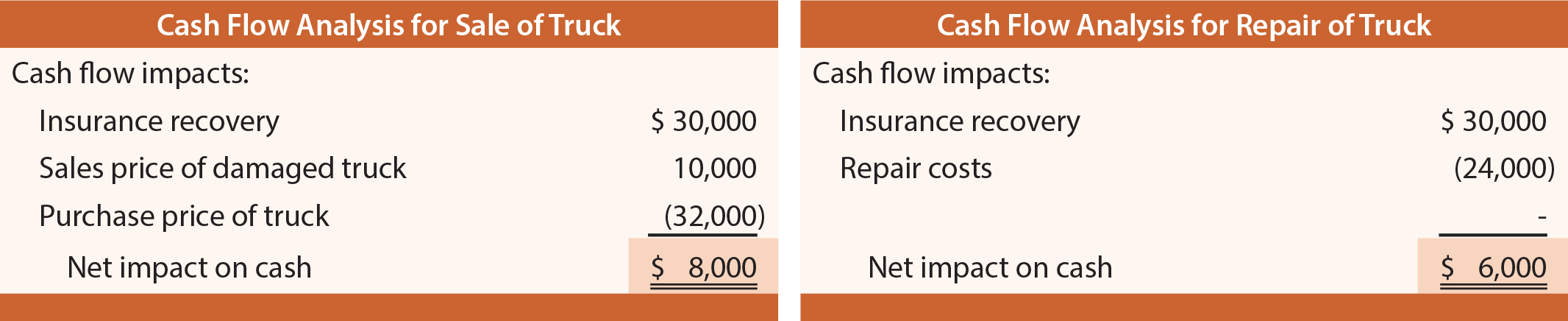

The logic implied by the preceding discussion is to focus on incremental items that differ between the alternatives. The same conclusion can be reached by a more comprehensive analysis of all costs and benefits:

The preceding analysis also supports sale and replacement because the income and cash flow impacts are $2,000 better than with the repair option. Although the detailed analysis may be more descriptive of the entirety of the two alternatives, it can become unnecessarily burdensome. It bears repeating that decision making should be driven only by relevant costs/benefits that differ among the alternatives! To toss in the extraneous data may help describe the situation, but it is of no benefit in attempting to guide decisions.

In one sense, Dillaway was lucky. The insurance proceeds were more than enough to put Dillaway back in operation. Many times, a favorable outcome cannot be identified. Each potential decision leads to a negative result. Nevertheless, decisions must be made. As a result, proper incremental analysis often centers on choosing the option of least incremental harm or loss.

Other Factors

Relevant costs/benefits are rarely so obvious as illustrated for Dillaway. Suppose the local truck dealer offered Dillaway a third option: a $27,000 trade-in allowance toward a new truck costing $80,000. The incremental cost of this option is $53,000 ($80,000 – $27,000). This is obviously more costly than either of the other two options. But, Dillaway would have a brand new truck. As a result, Dillaway must now begin to consider other qualitative factors beyond those evident in the incremental cost analysis. This is often the case in business decision making. Rarely are two (or more) options under consideration driven only by quantifiable mathematics. Managers must be mindful of the impacts of decisions on production capacity, customers, employees, and other qualitative factors. Consider that qualitative factors can heavily influence long-run quantitative outcomes.

Relevant costs/benefits are rarely so obvious as illustrated for Dillaway. Suppose the local truck dealer offered Dillaway a third option: a $27,000 trade-in allowance toward a new truck costing $80,000. The incremental cost of this option is $53,000 ($80,000 – $27,000). This is obviously more costly than either of the other two options. But, Dillaway would have a brand new truck. As a result, Dillaway must now begin to consider other qualitative factors beyond those evident in the incremental cost analysis. This is often the case in business decision making. Rarely are two (or more) options under consideration driven only by quantifiable mathematics. Managers must be mindful of the impacts of decisions on production capacity, customers, employees, and other qualitative factors. Consider that qualitative factors can heavily influence long-run quantitative outcomes.

Remember that the analytical techniques presented throughout this chapter are based on concrete illustrations and logic. However, success in business depends upon much more than just adapting these sound conceptual approaches to a business world that is filled with uncertain and abstract problems. Do not assume that analytical methods can be used to solve all business problems, but do not abandon them in favor of wild guesswork! Analytics support decision making, but they do not supplant judgment.

| Did you learn? |

|---|

| What is a relevant cost, and what is a sunk cost? |

| Why does decision making necessarily focus on the future? |