Expense recognition will typically follow one of three approaches, depending on the nature of the cost:

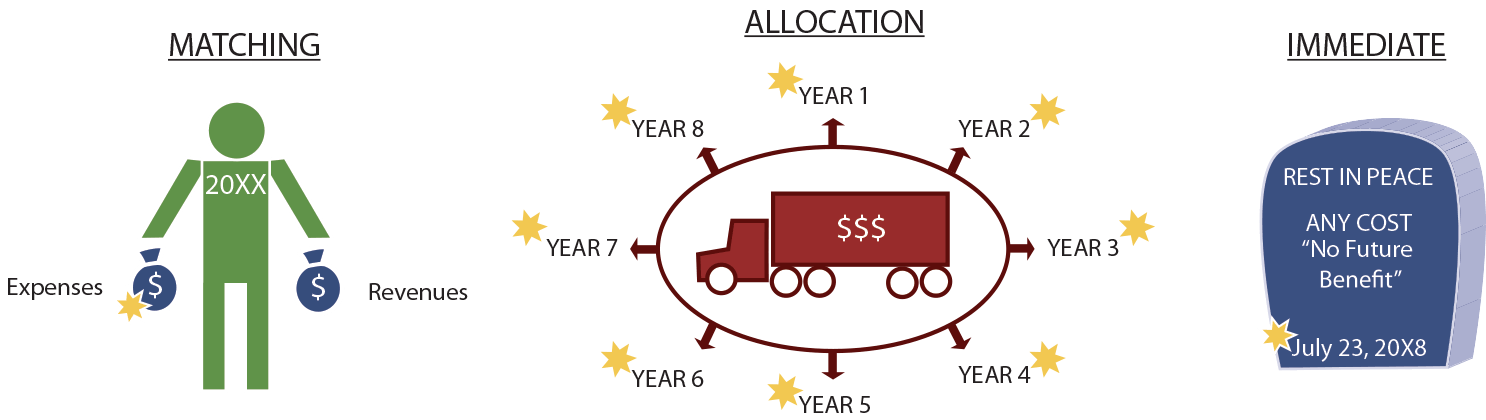

- Associating cause and effect: Many costs are linked to the revenue they help produce. For example, a sales commission owed to an employee is based on the amount of a sale. Therefore, commission expense should be recorded in the same accounting period as the sale. Likewise, the cost of inventory delivered to a customer should be expensed when the sale is recognized. This is what is meant by associating cause and effect, and is also referred to as the matching principle.

- Systematic and rational allocation: In the absence of a clear link between a cost and revenue item, other expense recognition schemes must be employed. Some costs benefit many periods. Stated differently, these costs expire over time. For example, a truck may last many years; determining how much cost is attributable to a particular year is difficult. In such cases, accountants may use a systematic and rational allocation scheme to spread a portion of the total cost to each period of use (in the case of a truck, through a process known as depreciation).

- Immediate recognition: Last, some costs cannot be linked to any production of revenue, and do not benefit future periods either. These costs are recognized immediately. An example would be severance pay to a fired employee, which would be expensed when the employee is terminated.

Payment vs. Recognition

It is important to note that receiving or making payments are not criteria for initial revenue or expense recognition. Revenues are recognized at the point of sale, whether that sale is for cash or a receivable. Expenses are based on one of the approaches just described, no matter when payment occurs. Recall the earlier definitions of revenue and expense, noting that they contemplate something more than simply reflecting cash receipts and payments. Much business activity is conducted on credit, and severe misrepresentations of income could result if the focus was simply on cash flow.

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| What are the three general rules, with examples of each, for expense recognition? |

| Understand the importance of the matching principle to expense recognition and income measurement. |

| Distinguish between payment and recognition. |