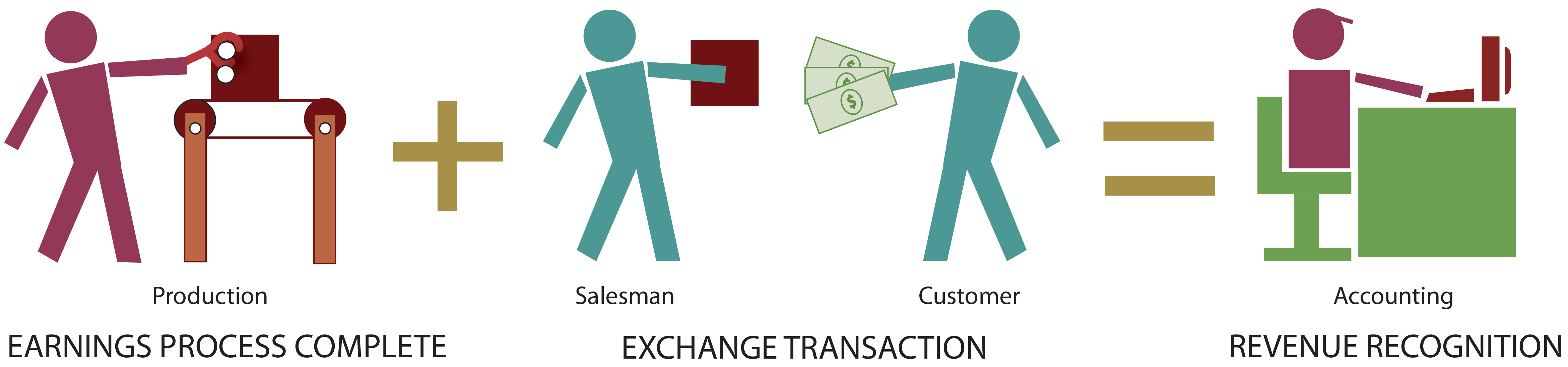

To recognize an item is to record it into the accounting records. Revenue recognition normally occurs at the time services are rendered or when goods are sold and delivered. The conditions for revenue recognition are (a) an exchange transaction, and (b) the earnings process being complete.

For a manufactured product, should revenue be recognized when the item rolls off of the assembly line? The answer is no! Although production may be complete, the product has not been sold in an exchange transaction. Both conditions must be met. In the alternative, if a customer ordered a product that was to be produced, would revenue be recognized at the time of the order? Again, the answer is no! For revenue to be recognized, the product must be manufactured and delivered.

Modern business transactions frequently involve complex terms, bundled items (e.g., a cell phone with a service contract), intangibles (e.g., a software user license), order routing (e.g., an online retailer may route an order to the manufacturer for direct shipment), achievement of milestones (e.g., payment contingent on reaching research and development results), and so forth. Many past accounting failures involved misapplication of revenue recognition concepts. As a result the profession has moved to provide further guidance that should be instructive on how to account for more complex contracts. Stepwise, the approach is as follows:

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

As one may well imagine, a great deal of judgment is needed to apply this general framework to case specific situations. Expect to consider this topic in advanced accounting courses and beyond.

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| Know the meaning of the word “recognize.” |

| Be able to recite the basic conditions precedent to revenue recognition. |

| Have a basic understanding of the steps that are to be considered in complex revenue recognition scenarios. |