Recall from Chapter 6 that highly-liquid investments made with the intent of reselling them in the near future are classified on the balance sheet as current assets. They are reported at fair market value, and the changes in value are measured and included in the operating income of each period. This chapter will examine other investments, many of which may be acquired with the intent of holding them for an extended period. The specific accounting treatment for these longer-term investments varies based on the nature and intent of the investment.

Recall from Chapter 6 that highly-liquid investments made with the intent of reselling them in the near future are classified on the balance sheet as current assets. They are reported at fair market value, and the changes in value are measured and included in the operating income of each period. This chapter will examine other investments, many of which may be acquired with the intent of holding them for an extended period. The specific accounting treatment for these longer-term investments varies based on the nature and intent of the investment.

Debt

Sometimes one company may invest in debt securities issued by another company. One type of debt security is a “bond” (as in the popular term “stocks and bonds”). A bond payable is a mere “promise” (i.e., bond) to “pay” (i.e., payable). Thus, the issuer of a bond payable receives money today from an investor in exchange for a promise to repay the money, plus interest, over the future. In a later chapter, bonds payable will be examined from the issuer’s perspective. In this chapter, the preliminary examination of bonds will be from the investor’s perspective.

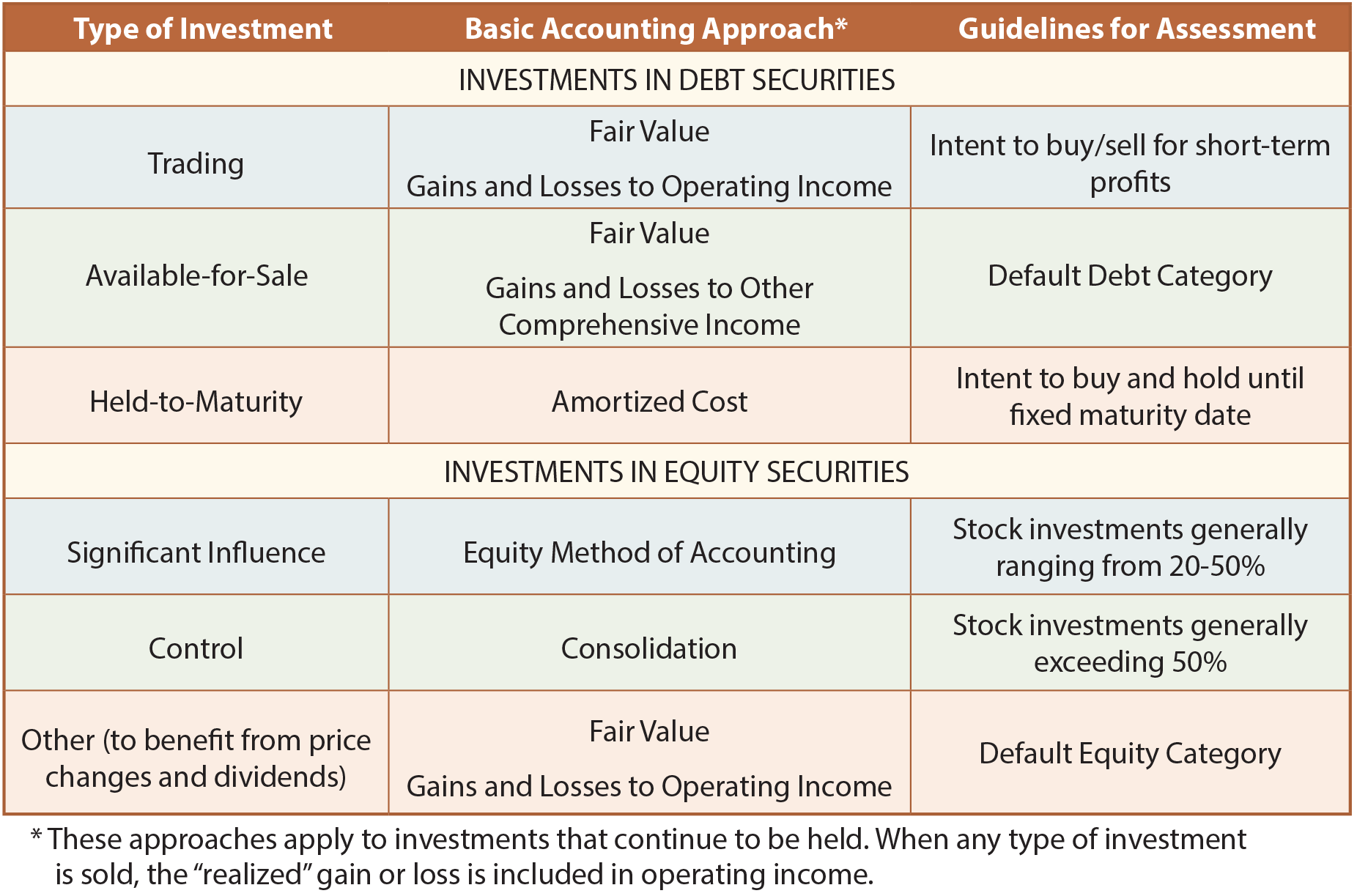

Bonds may be purchased for short-term “trading” purposes, in which case they are accounted for at fair value like other highly-liquid securities (as illustrated in Chapter 6). At other times, bonds are purchased as “available-for-sale,” meaning that there is an intent to hold but a willingness to sell. This category is reported at fair value on the balance sheet, but with a unique income statement reporting aspect. Many bond investments are acquired with the intent of holding them to a scheduled maturity (i.e., final payment date). This latter category is known as a “held-to-maturity” investment, and is afforded a special accounting treatment generally known as the amortized cost approach.

Equity

Alternatively one company may acquire an ownership interest in the equity of another company (e.g., by investing in shares of the other company’s stock). The reason for such an investment may be as simple as trying to profit from an increase in the stock price of the other company, or to receive periodic dividends paid by the other company. At other times, the acquirer may desire to obtain control of the other company, usually by buying more than 50% of the stock. In this case, the acquirer (sometimes known as the parent) must include the accounts of the acquired subsidiary in with their own through a process called consolidation. Yet another situation is the acquisition of a substantial amount of the stock of another but without obtaining control. This situation generally arises when the ownership level rises above 20%, but stays below 50%. In these cases, the investor is deemed to have the ability to significantly influence the investee company. Accounting rules specify the “equity method” of accounting for such investments.

The following table summarizes the methods one will be familiar with by the conclusion of this chapter:

Fair Value Option

Companies may also elect to measure certain financial assets (and liabilities) at fair value. This option essentially allows for a company to bypass the above table (other than where consolidation or equity method accounting is warranted) and instead measure an investment at fair value. When fair value accounting is elected, the unrealized gains and losses are reported in operating income, similar to the approach used for short-term investments illustrated in Chapter 6. This relatively new accounting option is indicative of a continuing evolution by the Financial Accounting Standards Board toward value-based accounting in lieu of traditional historical cost-based approaches. Importantly, the decision to apply the fair value option to a particular investment is irrevocable.

| Did you learn? |

|---|

| What are the general rules for deciding which method is used to account for an investment in the stock of another company? |

| Understand how intent influences the accounting technique for a particular investment. |

| Describe the basic accounting approaches and guidelines for assessment relating to different types of investments. |

| Know about the fair value option for measuring and reporting investments. |