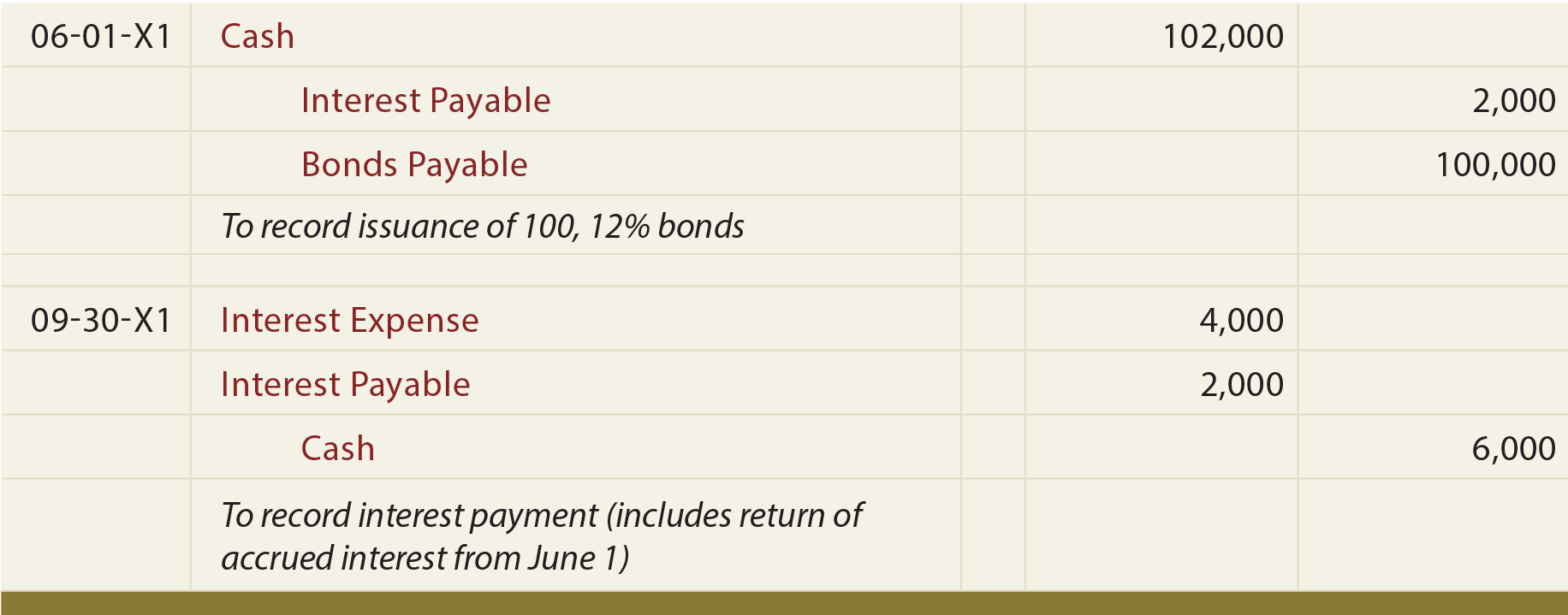

Bonds issued between interest dates are best understood in the context of a specific example. Suppose Thompson Corporation proposed to issue $100,000 of 12% bonds, dated April 1, 20X1. However, despite the April 1 date, the actual issuance was slightly delayed, and the bonds were not sold until June 1. Nevertheless, the covenant pertaining to the bonds specifies that the first 6-month interest payment date will occur on September 30 in the amount of $6,000 ($100,000 X 12% X 6/12). In effect, interest for April and May has already accrued at the time the bonds are actually issued ($100,000 X 12% X 2/12 = $2,000). To be fair, Thompson will collect $2,000 from the purchasers of the bonds at the time of issue, and then return it within the $6,000 payment on September 30. This effectively causes the net difference of $4,000 to represent interest expense for June, July, August, and September ($100,000 X 12% X 4/12). The resulting journal entries are:

Year-End Interest Accruals

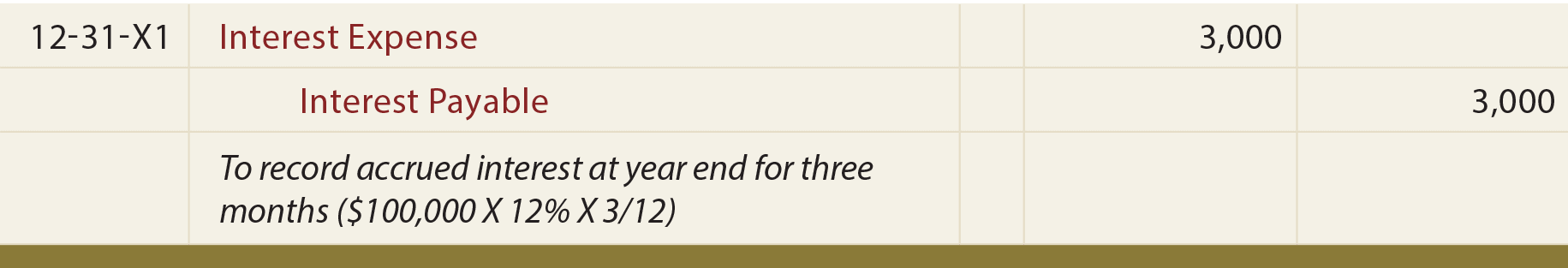

Notice that interest was paid in full through September 30. Therefore, the December 31 year-end entry must reflect the accrual of interest for October through December:

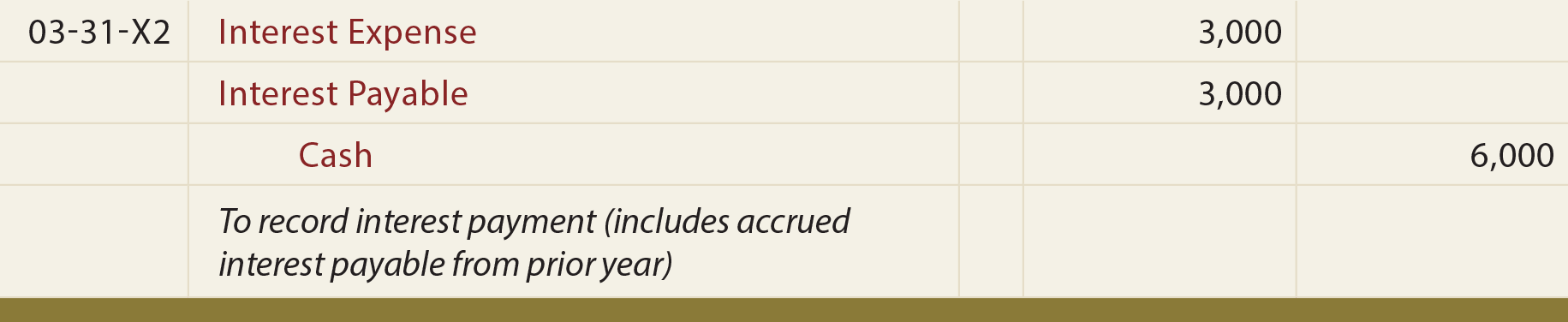

When the next interest payment date arrives on March 31, the actual interest payment will cover the previously accrued interest, and additional amounts pertaining to January, February, and March:

If these bonds had been issued at other than par, end-of-period entries would also include adjustments of interest expense for the amortization of premiums or discounts relating to elapsed periods.

Bonds Retired Before Scheduled Maturity

Early retirements of debt may occur because a company has generated sufficient cash reserves from operations, and the company wants to stop paying interest on outstanding debt. Or, interest rates may have changed, and the company wants to take advantage of more favorable borrowing opportunities by “refinancing.”

Whether the debt is being retired or refinanced in some other way, accounting rules dictate that the extinguished obligation be removed from the books. The difference between the old debt’s net carrying value and the amounts used for the payoff should be recognized as a gain or loss.

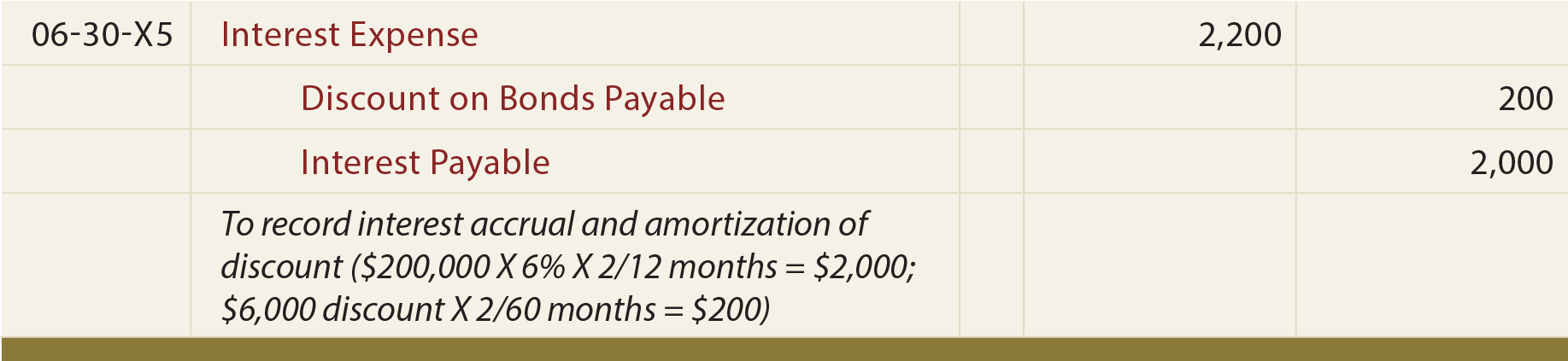

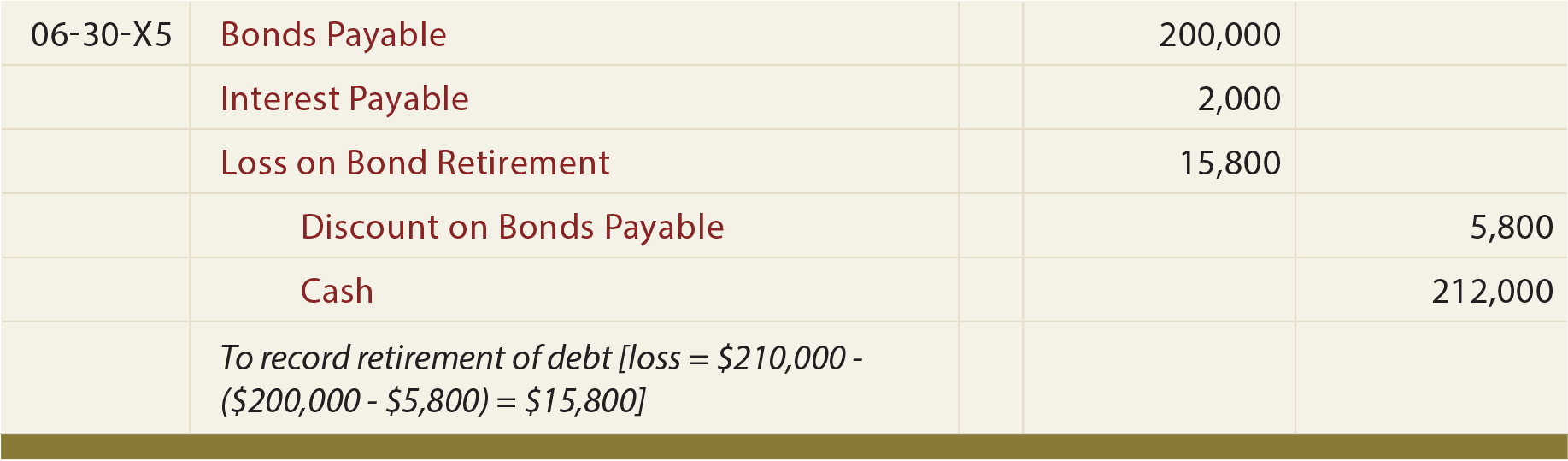

For instance, assume that Cabano Corporation is retiring $200,000 face value of its 6% bonds payable on June 30, 20X5. The last semiannual interest payment occurred on April 30. The unamortized discount on the bonds at April 30, 20X5, was $6,000, and there was a 5-year remaining life on the bonds as of that date. Further, Cabano is paying $210,000, plus accrued interest to date ($2,000), to retire the bonds; this “early call” price was stipulated in the original bond covenant. The first step to account for this bond retirement is to bring the accounting for interest up to date:

Then, the actual bond retirement can be recorded, with the difference between the up-to-date carrying value and the funds utilized being recorded as a loss (debit) or gain (credit). Notice that Cabano’s loss relates to the fact that it took more cash to pay off the debt than was the debt’s carrying value of $194,200 ($200,000 minus $5,800).

The Fair Value Option

Be aware that bonds can change in value. Remember that the value of a bond is a function of the bond’s stated rate of interest in relation to the going market rate of interest. If market interest rates rise, look for a market value decline (reflecting a lower present value based on the higher discount rate) and vice versa. Companies are permitted, but not required, to recognize changes in value of such liabilities. Entities that opt for this approach are to report unrealized gains and losses in earnings at each reporting date, and the balance sheet will be revised to reflect the fair value of the obligation.

Specific rules dictate the process and judgment for determining fair value. If a company’s debt is traded in a public market, the valuation would be based on its observable price (“Level 1”). If the debt does not have a clearly determinable market, pricing would be tied to similar securities (“Level 2”). Management may develop their own pricing models in the rare case where the value is not otherwise observable (“Level 3”).

| Did you learn? |

|---|

| Determine the appropriate procedures for bonds issued between interest payment dates. |

| Determine the appropriate year-end accounting for bonds issued at par, a discount, or a premium. |

| Understand the potential impact of a bond retirement. |