Not all discrete units within a business organization are focused on production of the end product. Janitorial services, cafeterias, health clinics, and the like support productive units. Service department costs are allocated to operating units via an allocation process. This allocation occurs to support measurement of full product cost (as contemplated by GAAP), to make managers of operating units aware of the complete cost of their activities, and to discourage waste and inefficiency by over-utilization of service departments.

Not all discrete units within a business organization are focused on production of the end product. Janitorial services, cafeterias, health clinics, and the like support productive units. Service department costs are allocated to operating units via an allocation process. This allocation occurs to support measurement of full product cost (as contemplated by GAAP), to make managers of operating units aware of the complete cost of their activities, and to discourage waste and inefficiency by over-utilization of service departments.

Direct Method

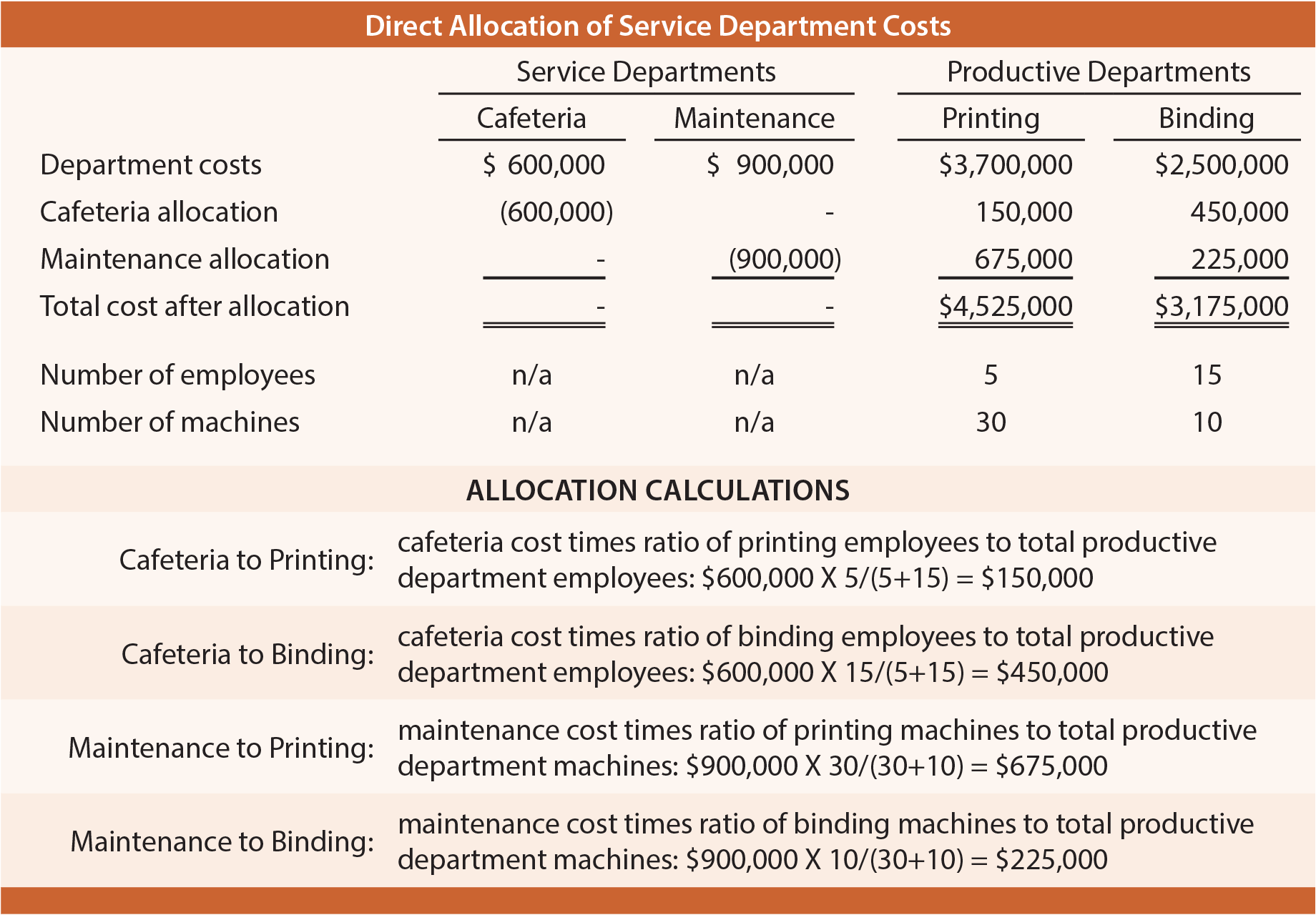

The direct method transfers the cost of a service department directly to the productive departments that rely on the services. The allocation is usually based upon some logical benchmark. For example, janitorial services may be allocated to productive departments based on square footage used by the productive departments. Cafeteria costs may be allocated based on the number of employees within each production department. The base selected should bear a logical relationship to the consumption of services and their costs.

Assume that Benjamin Printing has two production departments: printing and binding. Printing is highly automated. Binding relies on a far more labor-intensive process. These departments are supported by maintenance and cafeteria service units. Maintenance activities are driven by the amount of machinery requiring service and repair. Cafeteria services is directly related to the size of the labor pool. As shown, costs incurred by the Maintenance Department are allocated based on number of machines used by each productive department. Cafeteria costs are allocated based on number of employees.

Step Method

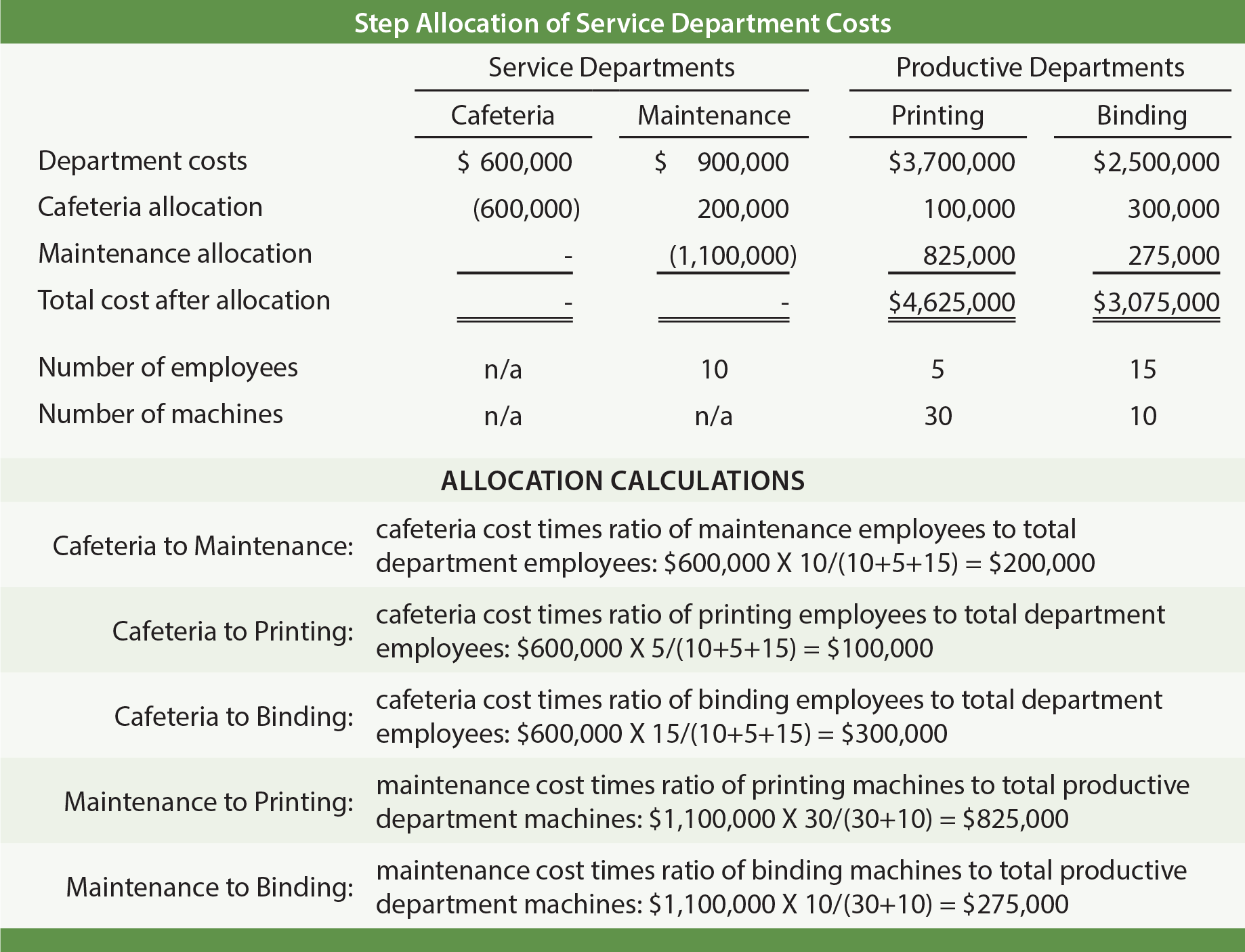

Some service departments may provide support to other service departments. For instance, Benjamin’s maintenance employees likely eat in the cafeteria. This issue is mitigated by a step method of allocation. A service department’s cost is first allocated to other units, including other service departments. Then, the “resulting costs” of the other service departments are allocated to production. This step allocation is demonstrated for Benjamin, assuming that cafeteria costs benefit maintenance, printing, and binding:

| Did you learn? |

|---|

| Be able to distinguish between direct and step methods of allocating service department costs. |